Investing.com - The pound rose against the dollar on Friday after Bank of England Governor Mark Carney said interest rates may rise earlier than markets have been anticipating.

In U.S. trading on Friday, GBP/USD was trading up 0.22% at 1.6965, from a session low of 1.6922 and off a high of 1.6991.

Cable was likely to find support at 1.6739, Wednesday's low, and resistance at 1.6997, the high from May 6.

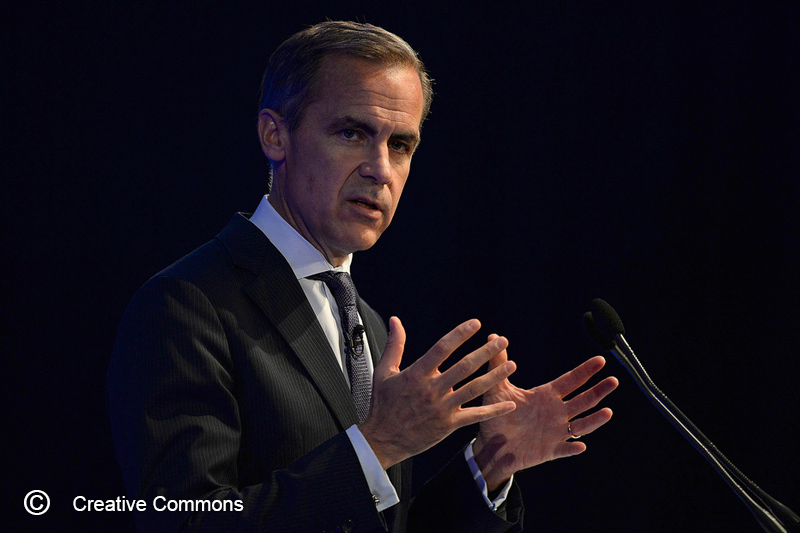

Markets have long been suspecting the Bank of England to raise interest rates before other major central banks, and BoE Governor Carney confirmed those sentiments in a speech he delivered on Thursday.

"There’s already great speculation about the exact timing of the first rate hike and this decision is becoming more balanced," Carney said in prepared remarks of his speech.

"It could happen sooner than markets currently expect."

Carney's words bolstered the pound, while soft U.S. data weakened the dollar against its U.K. counterpart.

In a preliminary report, the Thomson Reuters/University of Michigan consumer sentiment index fell to 81.2 this month from 81.9 in May, whose figure was revised up from a previously estimated reading of 81.8. Analysts had expected the index to rise to 83.0 in June.

Also on Friday, official data showed that U.S. producer price inflation fell 0.2% in May, confounding expectations for a 0.1% rise, after a 0.6% increase the previous month.

Core producer price inflation, which excludes food, energy and trade, slipped 0.1% last month, compared to expectations for an increase of 0.1%, after a 0.5% rise in April.

Meanwhile, markets continued to track a rebellion in Iraq led by a Sunni Islamist group.

Markets breathed a sigh of relief after U.S. President Barack Obama said he won't sent troops to Iraq and added oil continues to flow normally out of the country, which supported the greenback.

Elsewhere, sterling was up against the euro, with EUR/GBP down 0.35% at 0.7978, and up against the yen, with GBP/JPY up 0.52% at 173.07.

At its monthly policy-setting meeting, the Bank of Japan said it will continue to expand the monetary base at a pace of ¥60 trillion to ¥70 trillion per year, which weakened the yen and boosted demand for the dollar.

BoJ Governor Haruhiko Kuroda had said last week that the central bank's easing measures are having the intended effects and are helping the economy.