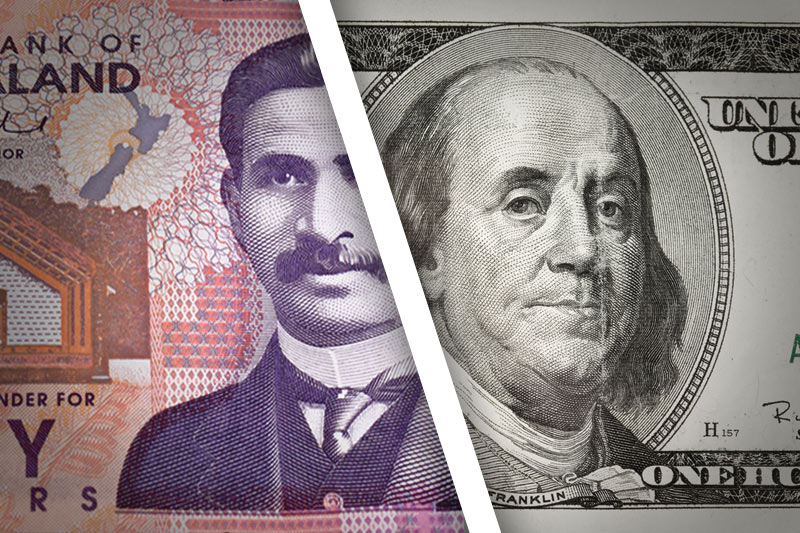

Investing.com - The New Zealand regained ground against its U.S. counterpart on Friday but held near a three-week low struck in the previous session as traders continued to weigh uncertainty surrounding developments in Ukraine.

NZD/USD fell to 0.8547 on Thursday, the pair’s lowest since April 4, before subsequently consolidating at 0.8580 by close of trade on Friday, up 0.18% for the day but still 0.11% lower for the week.

The pair is likely to find support at 0.8531, the low from April 4 and resistance at 0.8636, the high from April 24.

Concerns over the conflict between Russian and Ukraine escalated on Friday after U.S. Secretary of State John Kerry warned that Washington was ready to step up economic sanctions against Russia.

Meanwhile, ratings agency Standard & Poor’s cut its rating on Russia on Friday, citing the potential for “additional significant outflows” of capital due to escalating hostilities with Ukraine.

The West is accusing Russia of leading a separatist revolt in eastern Ukraine after it annexed Crimea last month.

Market players also continued to monitor U.S. data for further indications on the strength of the economy and the future course of monetary policy.

Data on Friday showed that consumer confidence rose to a nine-month high in April, adding to signs that the economy is improving.

The University of Michigan reported that its consumer sentiment index came in at 84.1 this month, up from 80 in March and the preliminary reading of 82.6. Analysts had expected the index to rise to 83.0.

Elsewhere, in New Zealand, the Reserve Bank raised interest rates by 0.25% earlier in the week and increased its growth estimate for the quarter ending in March.

In a widely expected move, the RBNZ raised its benchmark interest rate to 3.00% from 2.75%.

The central bank also said that gross domestic product is estimated to have grown 3.5% in the year to March, compared to the previous month's estimate of 3.3%.

Commenting on the decision, RBNZ Governor Graeme Wheeler said the strong kiwi is helping to contain inflation, though current levels may not be sustainable.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the New Zealand dollar in the week ending April 22.

Net longs totaled 20,175 contracts as of last week, compared to net longs of 18,213 contracts in the previous week.

In the week ahead, investors will be looking ahead to Wednesday’s monetary policy announcement by the Federal Reserve amid speculation the central bank is likely to continue to scale back its stimulus program.

The U.S. will also release the monthly non-farm payrolls report for April later in the week as well as a preliminary estimate on first quarter economic growth.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets.

Monday, April 28

The U.S. is to release private sector data on pending home sales.

Tuesday, April 29

New Zealand is to publish data on the trade balance, the difference in value between imports and exports.

The U.S. is to a report compiled by the Conference Board on consumer confidence.

Wednesday, April 30

New Zealand is to release data on building consents and business confidence.

The U.S. is to release preliminary data on first quarter GDP, as well as the ADP report on private sector job creation, which leads the government’s nonfarm payrolls report by two days. The U.S. is also to release data on manufacturing activity in the Chicago region.

Later Wednesday, the Federal Reserve is to announce its federal funds rate and publish its rate statement.

Thursday, May 1

China is to release official data on manufacturing activity. The Asian nation is New Zealand’s second-biggest trade partner.

The U.S. is to publish the weekly report on initial jobless claims. At the same time, Fed Chair Janet Yellen is to speak at an event in Washington; her comments will be closely watched.

Later Thursday, the Institute of Supply Management is to release a report on manufacturing activity.

Friday, May 2

The U.S. is to round up the week with the closely watched government data on nonfarm payrolls and the unemployment rate, and a separate report on factory orders.