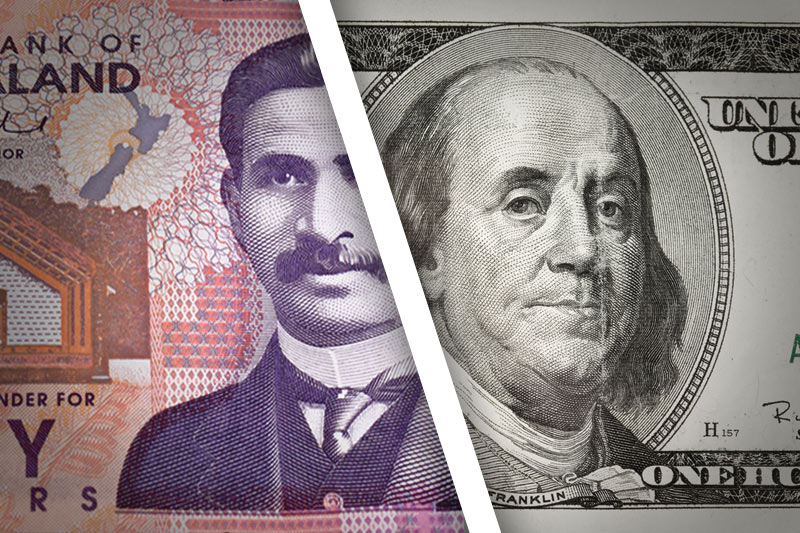

Investing.com - The New Zealand weakened against its U.S. counterpart on Friday, as investors continued to look past a recent series of disappointing U.S. economic reports, attributing them to severely cold winter weather.

NZD/USD fell to 0.8241 on Thursday, the pair’s lowest February 7, before subsequently consolidating at 0.8281 by close of trade, down 0.28% for the day and 1.05% lower for the week.

The pair is likely to find support at 0.8241, the low from February 20 and resistance at 0.8342, the high from February 19.

Dallas Federal Reserve President Richard Fisher said Friday that the Fed should continue to taper its asset-purchase program.

Separately, St. Louis Fed President James Bullard said the U.S. economy is headed for a good year of growth and he expects the Fed to continue rolling back its stimulus program.

Their comments came after data showed that U.S. existing home sales fell by a larger-than-forecast 5.1% in January to hit an 18-month low.

Wednesday’s minutes of the Fed’s January meeting showed that officials agreed the current pace of reductions to the bank’s asset purchase program would remain unchanged, so long as the economy shows signs of improvement.

Official also discussed when to begin raising interest rates, the minutes said.

The U.S. central bank is currently purchasing $65 billion of assets per month.

Data from the Commodities Futures Trading Commission released Friday showed that speculators increased their bullish bets on the New Zealand dollar in the week ending February 18.

Net longs totaled 8,906 contracts as of last week, up 14.2% from net longs of 7,641 contracts in the previous week.

In the week ahead, market players will continue to pay close attention to U.S. economic data releases for further indications on the strength of the economy and the future course of monetary policy.

The U.S. is to publish revised data on fourth quarter economic growth, while data on durable goods orders and consumer confidence will also be in focus.

Ahead of the coming week, Investing.com has compiled a list of these and other significant events likely to affect the markets. The guide skips Monday, as there are no relevant events on this day.

Tuesday, February 25

New Zealand is to produce data on inflation expectations.

The U.S. is to release data on consumer confidence and a private sector report on house price inflation.

Wednesday, February 26

The U.S. is to release data on new home sales, a leading indicator of demand in the housing market.

Later Wednesday, New Zealand is to release a report on the trade balance.

Thursday, February 27

The U.S. is to release data on durable goods orders, a leading indicator of production, and the weekly report on initial jobless claims.

Friday, February 28

New Zealand is to release data on business confidence.

The U.S. is to round up the week with revised data on fourth quarter growth, a report on manufacturing activity in the Chicago region, revised data on consumer sentiment and private sector data on pending home sales.