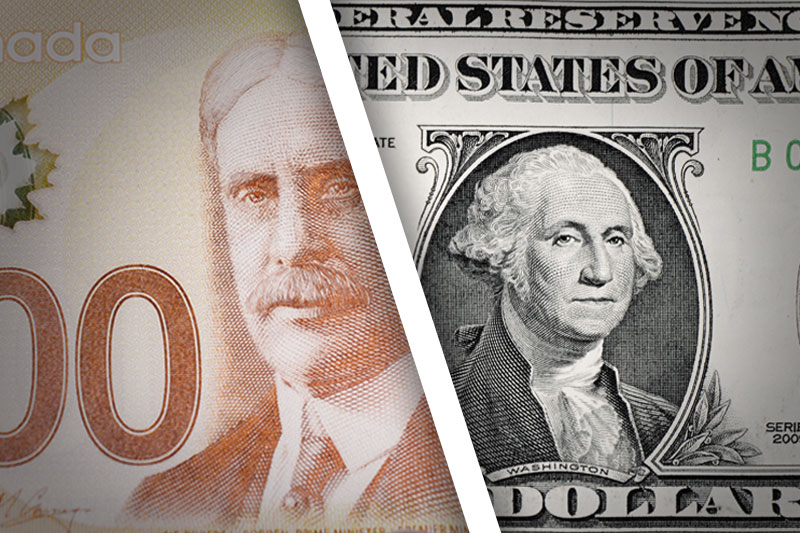

Investing.com - The U.S. dollar pulled back from four-year highs against the Canadian dollar on Wednesday as recent strong gains prompted investors to take profits, but losses looked likely to remain limited following the release of upbeat U.S. data.

USD/CAD rose to highs of 1.0990, the strongest level since September 2009 and was last up just 0.03% to 1.0951.

The pair was likely to find support at 1.0900 and resistance at 1.1075.

Demand for the dollar continued to be underpinned after data released on Wednesday showed that U.S. producer price inflation rose at the strongest rate in six months in December.

Producer price inflation rose 0.4% last month, the biggest increase since June, recovering from a 0.1% decline in November and was 1.2% higher from a year earlier.

Core PPI was up 0.3% in December and rose 1.4% on a year-over year basis, compared to expectations for a monthly increase of 0.1% and an annual gain of 1.3%.

A separate report showed that manufacturing activity in the Empire State expanded at the fastest pace since May 2012 this month.

The Federal Reserve Bank of New York said that its general business conditions index jumped to 12.51 in January from an upwardly revised 2.22 in December. Analysts had expected the index to rise to 3.75.

The data reinforced expectations that the U.S. economic recovery will continue to deepen going into this year and offset lingering concerns over last week’s surprising poor U.S. nonfarm payrolls report.

The Canadian dollar remained under heavy selling pressure after dire employment data last week cemented expectations that the Bank of Canada will stick to its dovish stance on interest rates.

Elsewhere, the loonie, as the Canadian dollar is also known, moved higher against the euro, with EUR/CAD down 0.50% to 1.4897, after rising to three-year highs of 1.4992 earlier in the session.