The Risks Still Exist:

The major risk in the short run is the decrease in demand forIsraeli goods and services (mainly technology) and the existingprobability of a systemic risk, mainly from the United States and fromthe European Union. The other risks include rising unemployment, soonerthan expected interest rate hikes, and future tax increases due to therising of budget deficit. These risks support the view that therecovery will not be a V-Shaped.

There are two high-probability scenarios: the first one is aW-Shaped recovery. This means that the period of recovery and expansionwill be relatively short lived - unlike in a normal business cycle thatnormally lasts more than 40 months. The second scenario is prolongedand anemic recovery that will be followed by at least 2-3 years offeeble economic growth.

Leading Indicators Rise, Led by Private Consumption and Export:

Since the beginning of 2009, there are increasing signs that therecession's trough is behind us, and we are heading toward a recovery.The Israeli investors received a "ratification" that the domesticeconomy is financially stable after the credit rating company Standard& Poor's kept Israel's A-Stable rating.

Also, domestic indicators such as privateconsumption, housing sales, and various fields of industrial productionsuggest that some industries stabilized in the second quarter.

Moreover, the leading indicators index rose by 0.2 percent inJune 2009 - the first increase since July 2008. The rise in June wasdue to an increase in exports. This is a good indicator since theexport sector is the most important growth-engine of the Israelieconomy. However, does it really signify a turning point?

Despite the encouraging signs, investors cannot ignore the factthat the risks still exist and most likely will have implications inthe medium-long term. First, the international trade sector remainedvery vulnerable. Second, there is still high uncertainty regarding thefuture developments abroad of the financial and credit market. Sincethe Israeli economy have a high dependency on demand from abroad, anymajor external shock will have a great effect on the economy.

What about the Internal Problem?

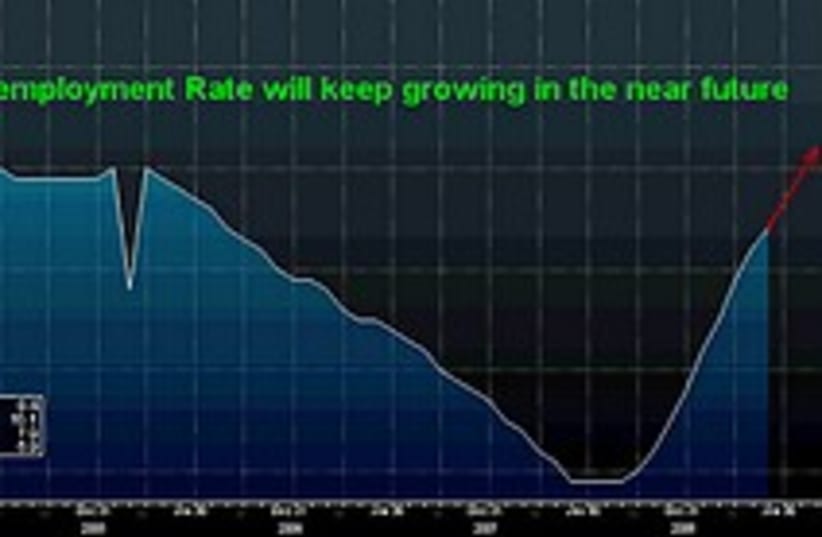

Even though the consumption sector shows signs of stability,there are internal risks that will most likely hurt consumers in themedium term. First, companies continue to cut operational costs andfire workers. The unemployment rate increased in May to 8.4% - thehighest rate in the last 3 years, and it is expected to rise to 9% bythe end of this year.

The implications will be a reduction of total demand and adecrease in government's revenue from taxes, which will push governmentdeficit further up. The government will have to increase taxes again in2010 in order to decrease its deficit. In addition, if inflation willremain high the bank of Israel (BOI) will raise interest rate and/orreduce money supply to control inflation. According to the Makam Market(Zero-coupon notes), BOI is expected to start raising rates by the endof the year.

Weak labor sector, tax increases and raising interest rateswill have a negative effect on consumers and the business sector,including on housing. These factors might lead to a second phase ofcontraction already in 2011-2012 or to a long period of anemic growthrate, which will have a negative effect on the stock market as well.

The writer is Chief Analyst and Strategist at Alumot-Sprint Investment House and also a regular writer for several leading financial papers and Web sites

| More about: | European Union, United States, Israel, Charles Henry Poor |