Any form of investment carries with it a certain amount of risk because no one can actually predict what the future will bring. That means a lot of care needs to be taken when setting up a retirement portfolio. The last thing anyone needs is to have their entire retirement funds eroded by inflation.

This brings us to the question of whether it is a good idea to invest in precious metals? If so, which precious metals IRA is best? In today’s economy which is battling runaway inflation, putting your faith in a trustworthy gold IRA company is certainly one of the best decisions you can make.

However, with the multitude of gold IRA companies available, choosing the best one to invest in might be difficult. That is why this article will look at some of the most sort-after gold IRA companies worth considering in 2022.

Three Best Gold IRA Companies of 2022

The value of a gold IRA company lies in the security it affords to the investor, the various services it can offer, and its fee structure. In that regard, the following are the three best gold IRA companies you can choose from:

- Goldco: Best Gold IRA Company Overall (Editor’s Choice)

- Augusta Precious Metals: Experts in Gold IRA Rollovers

- Noble Gold: Gold IRA Transfer to Gold Specialists

Below, is an in-depth analysis of each gold IRA company, to help you understand what you can expect from your precious metals IRA account:

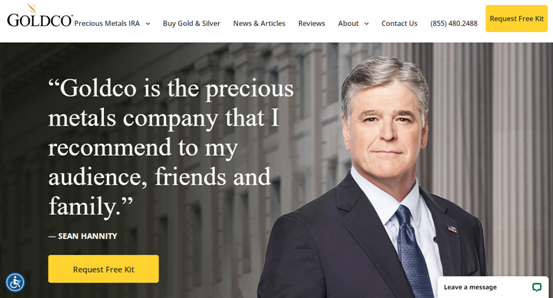

- Goldco (Editor's Choice)

Investors who already have funds sitting in a 401K account, 403B account, or any other form of IRA account will do well to consider Goldco if they want to switch to a gold IRA investment.

Goldco has been specializing in asset and wealth protection for many years by offering its clients a choice between both gold and silver IRAs. You can check out a Full GoldCo review here.

When it comes to the authenticity of its precious metals, Goldco is above reproach. It works directly with approved mints to guarantee quality gold bullion bars and silver, platinum, and palladium coins.

If an approved gold IRA portfolio is what you are interested in, then the gold coins, silver coins, and various other precious metals that are available at Goldco would be a worthy investment option for anyone.

It is also very easy to open a gold IRA account. All you need to do is go to their website and complete the account setup process by entering your details and signing an agreement form on the website.

Once that is done, in a short while a Goldco representative will contact you to help you with the rest of the process, and before you know it, you will have your own precious metals IRA set up and ready.

The next step is to fund your account, which is very easy if you happen to already have an active 401K, 403B, or some other suitable IRA portfolio in place. With an IRA rollover, you do not have to worry about tax penalties at all, so you are free to invest in a gold and silver IRA, at no added cost to you.

Customers without any existing retirement accounts need not worry, because there is an option that allows the direct purchase of gold bullion, precious metals, and gold and silver coins directly from Goldco.

Depending on the amount you buy, you could also qualify for free storage, which is not something offered by many precious metals IRA providers.

One great thing about this company that results in investors flocking to it is the Goldco fees structure. We have already mentioned the waiving of both taxes and storage fees, but the company also offers various perks, such as a 10% discount on silver for various precious metals purchases.

Visit the Official Goldco Website - Request Free Kit

Investors in gold IRAs know that when it comes to overseeing a gold IRA rollover, there is no better option than Augusta Precious Metals.

Considering that such a dependable gold IRA company was founded by none other than Joe Montana, the hall of famer and multi-championship winning quarterback, only makes it all the more impressive. You can check out the full Augusta Precious Metals review here.

The customer support offered by Augusta Precious Metals is one of the best, which is evident from the moment you begin talking to one of the gold and silver professionals available. They will probably advise you to take the most preferred route of funding your gold IRA accounts using existing IRA portfolios, or other sources, such as a 401K account.

Investing in other precious metal IRAs besides gold IRAs, such as silver, platinum, and palladium bullion is also very easy thanks to the assistance of the company's gold IRA experts. They will help you create your account, select the value of Gold IRAs you wish to invest in, complete the transfer, and choose the best storage facility.

Like the other top-tier Gold IRA companies featured in this article, Augusta Precious Metals features various options to purchase precious metals IRAs for those without approved IRA accounts or a 401K portfolio.

Direct cash purchases are possible, and if you choose this option, their agents will ensure that the process is easy and your Gold IRA is delivered safely and discreetly to your home.

What makes Augusta Precious Metals stand out among other gold IRA providers such as Birch Gold Group, is its association with trustworthy names, such as Equity Trust, a respected gold IRA custodian.

This is part of the reason it has so many positive reviews among gold IRA and precious metals investors, making it a contender for the title of best gold IRA Company in 2022.

—> Visit Augusta Precious Metals

With such a large number of people running away from investments, such as 401K accounts which are vulnerable to inflation, to more secure options, such as precious metals IRAs, most gold IRA companies have seen their importance skyrocket.

One such gold investing company with a stellar reputation among gold IRA investors is Noble Gold. It allows you to purchase precious metals IRAs, such as gold, silver, platinum, and palladium coins using existing retirement accounts, or directly from their website.

Even people who have never invested in precious metals IRAs before will find the online process to be very easy. You can even request one of the company's representatives to assist you. You can check out the full Noble Gold review here.

This easy-to-use, online gold IRA investments facility has been attracting younger investors to the company, and many of them have stayed due to the competitive pricing it also offers.

Once the account setup process is complete Noble Gold will contact its IRA custodian, Equity Institutional Investors, to confirm your registration and provide you with all the additional paperwork you may require.

One of the best features of this gold IRA investment company is that Noble Gold offers a Royal Survival Pack if you would prefer to buy physical precious metals directly. This pack consists of carefully selected highly liquid precious metals for use in case of emergency.

The direct investor pricing on the Noble Gold Website has some of the lowest prices for gold IRAs around. This, along with its great track record, quick delivery, and secure storage facilities makes it one of the most recommended gold investment companies to put trust with your retirement plans.

Detailed Look at a Gold IRA

Simply put, a gold IRA is an investment portfolio that uses precious metals, such as gold, silver, platinum, or palladium to secure the value of the account. This is an option that is not found in a traditional IRA, which is mostly based on paper assets, such as stocks and index funds.

Also, unlike a traditional IRA, any precious metal IRAs that are purchased must be stored in specialized storage facilities that are run by trusted IRA custodians. This will result in additional custodial fees on top of the regular gold IRA account fees the investor has to pay.

How We Ranked the Top Gold Investment Companies

Opening a gold and silver IRA account requires a significant amount of money, not less than $50,000 in most cases, meaning you have to be very careful when choosing the right gold and silver investment company.

To make it easier, we devised a ranking system that uses various features to decide which companies provide the best gold IRA services. We looked at the following important attributes:

Reviews and Reputation

A company that poorly handles investors' gold IRAs accounts will soon be well known as a bad investment choice. Various review platforms, such as Business Consumer Alliance, were vital in determining what previous clients had to say about their experience working with the company.

Any company with suspected fraudulent behavior, or that made it difficult for investors to withdraw funds was immediately excluded from the list. The remaining three choices on our list all have one thing in common, which is positive gold IRA reviews from many happy clients.

Setup Process

What sets these three companies apart from the rest is that the process of setting up new gold IRAs has been made very easy. Whether an investor wishes to purchase gold coins or silver bullion, there is always someone to assist.

Such an important decision to buy gold bullion as a means of investment would be expected to take weeks to finalize as it does in some companies.

However, unlike other gold IRA companies, the way these companies have streamlined the process means that in a few days, investors will be able to complete their IRA rollover, and rest assured that their investment portfolios are secured.

Associated Fee Structure

Investing in physical gold, silver, platinum, or palladium can be very expensive, to the point that if the wrong company is chosen, any advantages offered by this type of investment will be diminished.

This means all companies that charge extremely high annual fees are not suitable choices for opening an individual retirement account.

However, companies that offer free services are also not likely to be a premier gold IRA company, because such a service does come at a cost.

A proper precious metal IRA provider will not only have affordable precious metal prices but also provide the services of a financial advisor to make sure their clients are not overcharged and are making sound investment decisions.

Visit the Official Goldco Website - Request Free Kit

What To Look for in a Broker or Custodian for Your Gold-based IRA

Many gold IRA institutions make recommendations regarding the right custodian that their clients should use. This makes the job of finding a suitable broker much easier. However, at times, customers would wish to make their own choices.

If that is the case, then you are advised to conduct your own research into any potential custodians. There are many of them out there, but not all are trustworthy and reliable.

Look for a custodian with an impressive track record, and solid reputation, who offers a low minimum investment, and makes the whole process of acquiring precious metals easy.

First-time investors in precious metal assets should stick to well know custodians rather than take the risk of choosing a relatively unknown broker.

Common Types of Gold Usually Found in a Precious Metals IRA

The most important element in silver and gold investments is purity. Top gold IRA companies will always insist on 99.5% purity for gold, platinum, and palladium, and 99.9% purity for silver. This is why it is important to work with reputable companies to prevent the risk of being scammed.

Here Is Why You Need To Invest in Gold for Retirement

Investors in the stock market and other paper investments may be wondering whether there is any benefit in investing in regal assets, such as silver and gold coins. Well, gold, in particular, has the following benefits:

- Gold Value Is Stable

Over the centuries, the value of gold has remained stable, even while regular fiat currency options were struggling with economic problems.

One advantage gold and silver coins have over traditional IRAs is that no matter what happens, they are very unlikely to lose their value over a short period, which is always the fear fiat currency investors share.

- Provides a Hedge Against Inflation

The value of money is forever on a downward trajectory, even in strong currencies such as the US dollar. Such is the nature of these currencies that, over time, there will be a huge difference in current value compared to when it was first introduced.

Gold prices, however, have proved to be highly resistant to inflation, which is what is meant by hedging. Any retirement savings based on gold bars will remain a secure long-term investment.

What Exactly Is a Gold IRA Rollover?

A gold IRA rollover is when the gold and silver products IRA is opened by transferring or withdrawing funds from an existing IRA, to deposit them into a new account. This process is governed by strict IRS rules and regulations regarding precious metal portfolios which every gold IRA provider must adhere.

Visit the Official Goldco Website - Request Free Kit

Frequently Asked Questions

Why Is It Important To Invest in a Reputable Gold IRA Company?

There are many scammers out there in the world of gold IRA investing, who usually try to sell low-quality gold to investors, so it is always best to go for a trustworthy gold or silver IRA company.

Why Can't I Keep My Gold at Home?

One of the rules regarding gold or silver IRS-approved coins is that they cannot be kept at home. Keeping it at home will mean you risk being charged a 10% penalty, and also it is not as safe as approved storage places.

Final Thoughts

Investing in physical gold, silver, or any other precious metal is a very good investment, especially with the rampant inflation being witnessed around the world. If you want to safeguard your retirement accounts, then choose one of the companies from our list and initiate an IRA rollover.