The first lesson of economics is scarcity: there is never enough of anything to fully satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics. –Thomas Sowell

For many children, this week marked the first day of school. While social media is full of pictures of smiley kids as they merrily set out for another year of education, I’m always proud of our youngsters who believe in honesty. When it comes time for our pictures there are no smiles. Scowls rule the day! The first day is full of apprehension. Who is the teacher? Did they break up our class and add new kids? Maybe just one more day of vacation? It’s not until the last day of school, where there is that pure happiness that they made it through another year.

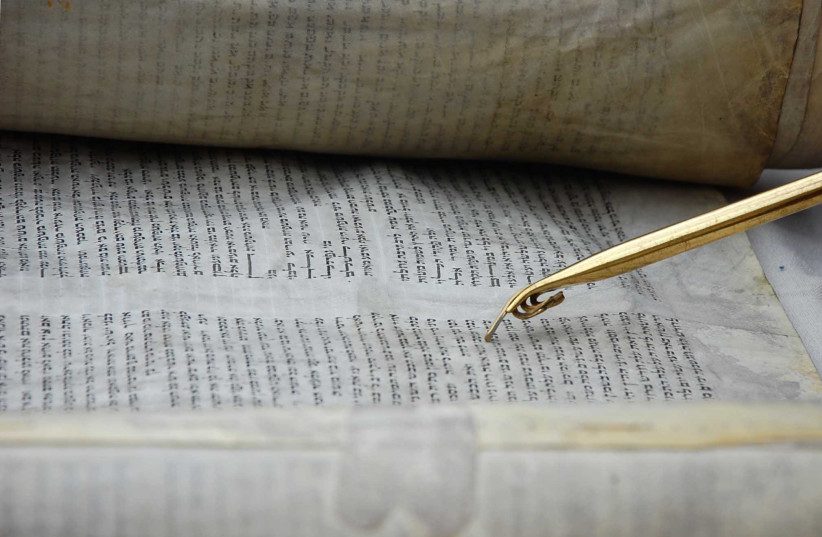

Speaking of firsts, this week we read the Torah portion of Ki Tavo. The beginning of the portion begins with the commandment to bring the first fruits. We learn about the farmer who months ago seeded a field not knowing what type of harvest there will be. Imagine the farmer who has toiled and toiled and finally sees the reward of the hard work, only instead of enjoying it by eating, he must bring it to Jerusalem, and make a declaration thanking the Lord for both the land and all the good that has been received.

As I have quoted many times, Rabbi Berel Wein writes, “Saying thank you is one of the basic courtesies of human interaction. Though elementary and straightforward, it is often forgotten or neglected. In saying thank you, we are acknowledging that we are dependent upon the goodness and consideration of others and that we are not completely in control over events and even of our own decisions in life.”

Too often we perceive our great achievements as a testament to our greatness and fall prey to “And you may say in your heart, ‘My strength and the might of my hand made this victory’.”

Rabbi Wein continues, “There is no question that the farmer invested a great deal of effort, sweat and toil in bringing his crops to fruition. Because of this effort and the investment on the part of the farmer, there is a temptation that he will view these new fruits as an entitlement. For after all, he was the one who devoted the time and effort necessary to produce them. There is a danger that he will forget that there really are no entitlements in life and that one has to say thank you for everything that is achieved, though ostensibly we have labored to achieve this much desired goal. Rather, it is incumbent upon the farmer to thank his Creator for the land and the natural miracles that occurred daily in the production of food, grain and fruit.”

Smart investments

All beginnings can be nerve-wracking, not just for students and farmers. Earlier this week I got a call from a friend who wanted to start investing. He told me that he had a serious amount of money sitting in the bank, and intellectually knew that something needed to be done but was afraid to invest. He told me he had read horror stories about investments gone wrong and was very nervous about starting.

I tried calming him by saying that if he trusted the process and kept things simple, that over the long run things should work out just fine. I mentioned to him that the stories he had read were about people who lost it all trading cocoa and orange juice futures or invested in African oil wells from some video they saw on social media about getting rich quick.

Those who bought broad-based index funds, or Exchange Traded Funds, or stuck with blue-chip stocks or invested in un-leveraged real estate, tended to do just fine over the long term. I reiterated what I always write about. That if you live within your means, save and invest and don’t try and be smarter than everyone else, you will go a long way towards having a secure financial future.

A few days ago, I met with someone who had a 401k pension account in the US. It turns out that he had not looked at it in more than 10 years. He was able to track it down and called customer service to request a statement. He told the story to the agent, and she laughed. She asked him how much he thought he had in the account. He said $80,000. She said that she had a big surprise for him. It’s now worth more than $220,000! He just invested in solid funds, didn’t do a thing, let the market do its magic and voila!

Don’t be apprehensive. Be smart. Invest intelligently and don’t try and get rich quick. Trust the process, don’t try and circumvent it, and you will be on your way to a bright financial future.

The information contained in this article reflects the opinion of the author and not necessarily the opinion of Portfolio Resources Group, Inc. or its affiliates.

Aaron Katsman is author of the book Retirement GPS: How to Navigate Your Way to A Secure Financial Future with Global Investing (McGraw-Hill), For more information, call (02) 624-0995 visit www.aaronkatsman.com or email aaron@lighthousecapital.co.il