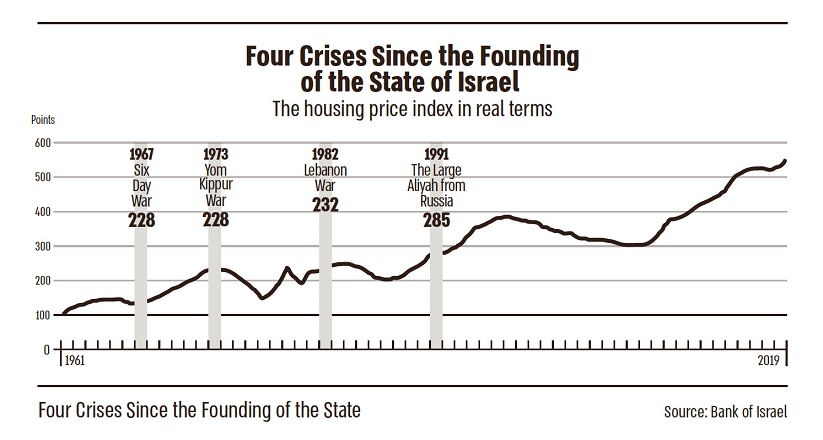

History has shown a consistent trend: price increases in Israel follow every crisis. The reason: Demand does not match the pace of construction. Dimri, one of the largest and most reputable real estate companies in Israel, offers projects at attractive prices for foreign residents.

Anyone tracking apartment prices in Israel understands that post-crisis, prices significantly rise. That's the scenario when demand is poised to soar, but construction starts cannot keep up.

Those familiar with the Israeli real estate market know that prices have consistently risen over time. The simple reason is that for most years, the supply of housing hasn't matched the demand.

However, different crises over the medium term have presented opportunities for savvy buyers who could navigate uncertainties and capitalize on these chances. These buyers knew how to purchase properties at significantly lower prices compared to the day after tomorrow's prices.

Apartment prices after the COVID crisis surged by over 10%

Unlike other countries worldwide, even during the COVID crisis, the real estate sector in Israel underwent the familiar process of a temporary freeze in property purchases in the short term and a surge in demand in the aftermath.

For instance, in 2021, there was a 30% increase in demand in Israel compared to 2020, and the significant decline in new construction led to a resurgence in the real estate sector both in quantity and prices.

Dimri, one of the leading real estate companies in Israel, experienced a more than 20% increase in the quantity of apartments and a 13% rise in the average price per unit. According to the company, while COVID suppressed demands, once the crisis ended, the rise in apartment prices was somewhat anticipated.

Security for Zionism: Significant rise in immigration requests to Israel following the conflict

The current crisis has generated a wave of antisemitism worldwide, leading to a substantial increase in immigration requests.

Data from the Ministry of Aliyah and Integration and the Jewish Agency indicate that requests for immigration from the US and Canada have nearly doubled. Among the Jewish population in France, a sharp increase was also observed.

Furthermore, even among those choosing to continue living in the US, there's a willingness to invest in Israeli properties as a kind of security net.

Dimri: Working hard to increase housing stock for the future

Amir Cohen, Vice President of Marketing and Sales at Dimri Real Estate, has faced numerous crises in the field, all ending in the same way: a temporary freeze, cautious investor purchases and those who knew the right time to buy property, followed by a return to the sales routine.

According to Cohen, what determines the market is the demand versus supply ratio. The major issue, as he sees it, is that crisis periods significantly diminish new construction starts.

Wise buyers are seeking opportunities now

Dimri stands as one of the major companies in Israel with over 34 years of experience, constructing over 3,000 housing units annually in 18 cities across the country. The real estate sector nearly froze in the past month, but already, a month after the conflict, an increase in demand is being witnessed.

Buyers are coming from both foreign residents and Israelis seeking opportunities. There's significant demand observed in our projects in Givatayim, Tel Aviv, Netanya, and Jerusalem. Jews, both in Israel and abroad, understand more than ever that they want to build their homes here.

Prices today are exceptionally attractive, even in flagship projects

Israeli real estate companies are offering projects at attractive prices to revive growth. Take Dimri, for example. The company's flagship project, IM Givatayim, is being sold at special prices. Similarly, projects along the coast in Netanya or flagship projects in Petah Tikva and Givat Shmuel have attractive offers.

“Buyers who can identify opportunities are already visiting sales offices,” Cohen says. “They know what to look for and what questions to ask. When the conflict ends, we all understand that the situation will return to its previous state.

“Ultimately, it's the demand versus supply that determines the market, and Israel still faces a significant shortage of housing compared to demand,” he says, adding that “after the conflict, the situation may get even worse."

For more information: Dimri

Email - omri@dimri.co.il

Phone number: +972-054-2529099

This article was written in cooperation with Dimri Real Estate