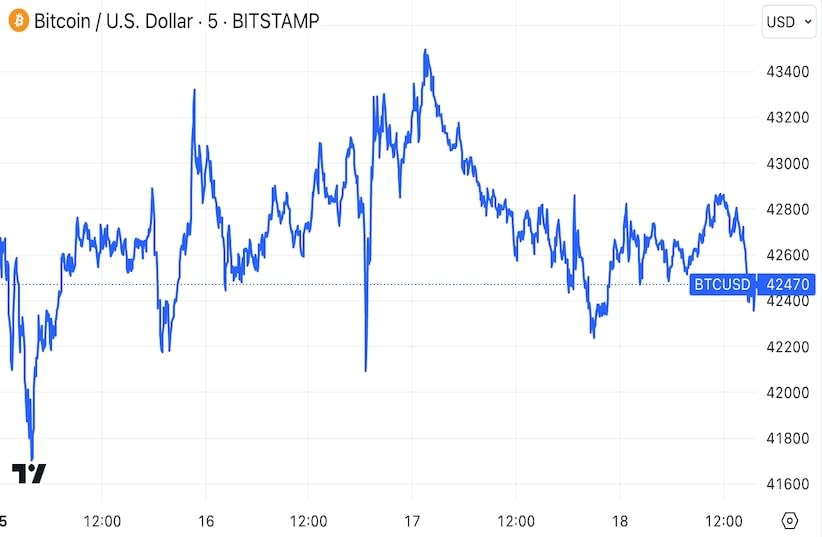

Following the eagerly awaited approval, which coincided with a local price peak near $49k, Bitcoin experienced a decline to a crucial support level at $42k. Unfortunately for investors, the approval of the spot product did not lead to a rapid increase in capitalization and liquidity flooding the market. Bitcoin ETF approval turned out to be overhyped news, marking the start of a corrective movement for the cryptocurrency.

Before delving into Bitcoin specifics, it's essential to acknowledge that the macroeconomic landscape is also significantly impacting the cryptocurrency situation. Investors are coming to terms with the realization that maintaining record-high interest rates may take longer. Goldman Sachs analysts have raised the US GDP forecast for 2024 from 2.1 % to 2.3 %, signaling potential additional inflationary risks. BlackRock analysts caution that investors might be overly optimistic about the imminent easing of monetary policy.

Consequently, investment activity in the crypto market has notably decreased, and BTC price is encountering increased difficulty in surpassing resistance zones. The gradual strengthening of the US dollar index is negatively influencing BTC's prospects, especially with a shifting focus toward Ethereum. Altcoins are showing significant growth, a classic outcome of a bull rally and further correction of BTC.

Trading in the long-awaited instrument, launched on January 11, 2024, saw the top three players emerge by January 17, occupying nearly 90% of the spot bitcoin-ETF market:

- Grayscale's Bitcoin Trust ETF (GBTC) (50%)

- Ishares Bitcoin Trust (IBIT) from BlackRock (21%)

- Wise Origin Bitcoin Fund (FBTC) from Fidelity (17%)

Analysts anticipate that the value of the leading cryptocurrency will be influenced by market players transitioning from the largest bitcoin trust, Grayscale Bitcoin Trust, to spot BTC ETFs from other issuers offering lower fees.

The current market situation draws parallels with 2019, where, in the lead-up to the halving, BTC experienced a significant drop in its exchange rate. In the worst-case scenario, the value of Bitcoin could potentially roll back to $23k.

This article was written in cooperation with TradingView