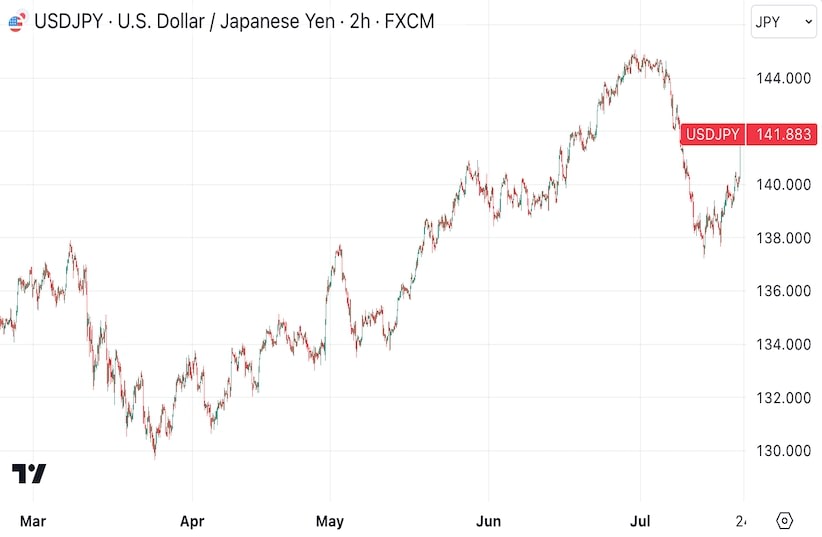

In a mid-year review released on Thursday, the Japanese government lowered its forecast for the country's economic growth for the current fiscal year to 1.3 % from 1.5 % anticipated in January. Will this factor affect the USD/JPY pair that has successfully been going upward for the last half a year? Let’s take a closer look.

Amidst global inflation concerns, Japan looks like a safe haven. The Bank of Japan declared ultra-soft monetary policy, which was again stated by its governor, Kazuo Ueda, at the G20 Financial Leaders Summit. The reason behind that is the fact that the inflation target of 2% is still far away. However, the BoJ head emphasized: monitoring of this process will be constant, and if any changes occur, adjustments will be made accordingly.

What immediately came to mind to forex traders was the US Federal Reserve’s intention to raise interest rates up to 5,75%. This hasn’t happened yet, as the Fed decided in July that the previous rate hikes were enough. As US inflation slowed to 3%, USD/JPY slipped 4% in a fortnight and thus marked another success for the bears. It also marked that central banks can be wrong too.

Several factors speak in favor of the prediction that the BoJ might change this course after all. Firstly, the Japanese bond yields are coming close to the upper boundary of the BoJ targeting range of +/-0.5%. Then there’s the inflation data that might become a reason to make adjustments. Bloomberg experts expect consumer prices to accelerate from 3.2% to 3.3% in June. The core indicator will continue to be close to the maximum for four decades, at 4.2%. Still, despite the upward trend in inflation, the Bank of Japan holds to its forecast for prices to eventually fall to 1.8%.

While the Bank of Japan might tighten its monetary policy, it is unlikely to happen in July. At the same time, robust US retail sales data reflects the resilience of the US economy and suggests that the dollar is somewhat oversold. This leads to the USD/JPY pullback upwards. As of writing, the pair is trading around 139 points, testing the round-level resistance of 140. The monetary policy of Japan might as well support the yen further.

To keep track of important data releases in the financial world, check the economic calendar. And don’t forget to conduct your own analysis before trading.

This article was written in cooperation with TradingView