What is the secret of identifying successful start-ups? How has the worldwide economic slowdown affected the start-up world? What steps should Israeli start-ups take to weather the storm?

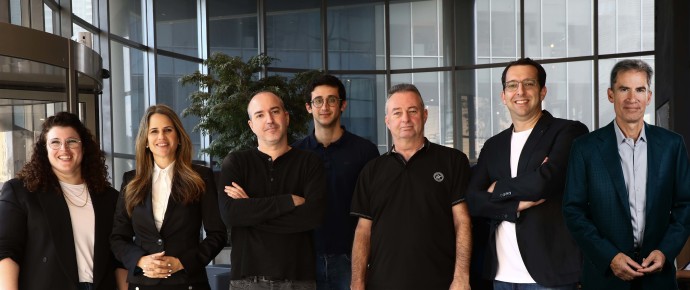

If anyone is qualified to weigh in on these matters, it is the leaders of New Era Capital Partners, one of Israel’s leading venture capital firms. Recently, managing partners and founders Gideon Argov and Ran Simha, together with partner Ziv Conen and vice president of business development Ayelet Frish, sat down with The Jerusalem Post in a wide-ranging discussion on the aforementioned issues. They also looked at what makes a successful venture capital firm, what distinguishes New Era from other venture capital firms, and how the firm identifies successful start-ups.

The conversation was held to mark the launch of a new series of six podcasts entitled No Limits: A New Era of Start-ups, which is featured on The Jerusalem Post Facebook page and is also available on leading podcast platforms, such as iTunes and Spotify. The first episode was released on Wednesday, January 18, and subsequent episodes will appear monthly.

New Era’s beginnings can be traced to the vision of Shimon Peres, Israel’s eighth prime minister and ninth president, who believed that technological advancement and positive social values are complementary.

New Era was founded in 2017. The fund focuses on early-stage investments in Israeli start-ups that use breakthrough technologies, emphasizing artificial intelligence and machine learning.

Ran Simha, who served as economic and technology advisor during the Peres presidency, explains that the founders were committed to creating a thriving venture capital that balanced technology with values. He also notes that New Era was the first venture capital fund that followed the UN Principles for Responsible Investment, incorporating environmental, social, and corporate governance factors into investment decision-making. The firm’s name – New Era – says Simha, reflects this approach: “We wanted to find a name that would symbolize what we aim for, which is to invest in a new era of companies, looking at their success on the financial side, as well as their values.” New Era strives to ensure that its portfolio companies follow the ESG (Environmental, Social, and Governance) criteria that guide the firm’s investment philosophy.

‘Technology can be harnessed not only for profit but also for positive societal and environmental results'

Gideon Argov, managing partner and co-founder, says that two factors separate New Era from other venture capital funds. “We believe that technology can be harnessed for making profits but also for positive societal and environmental results. Some of the most creative and capable technologists come out of Israel, and many of them care deeply about what kind of world they will live in.

“The second factor that distinguishes us is that we think we have a better mousetrap to make these companies more global more quickly. We have a good idea of how to accelerate the transition of these companies to become global players at an early stage.”

New Era has generated impressive results since its establishment. To date, the firm has invested in 25 companies in its two investment funds. The first fund invested in 10 companies and performed within the top 1% of its “vintage” of comparable peers. The second fund raised two and a half times as much as the first fund. All told, New Era manages $250 million between the two funds, says Simha, adding that the partners expect to begin raising the firm’s third fund in the middle to end of 2023.

“Our success as a venture capital fund,” says Simha, “is measured by one main thing: the return for investors – how fast you can return your invested capital and the multiple on the investment. There is a very clear benchmark based on vintages.”

He adds that among New Era’s limited-partner investors are well-known institutional investors, as well as industry personnel who run private equity and hedge funds, who have invested some of their own capital in the fund. This is one of the best indicators of the high regard in which New Era is held.

Argov explains that New Era utilizes the singular skills and networks of its three partners to locate companies with the best potential. Argov, who is based in the United States, has a 30-year background as a CEO of global businesses.

Ziv Conen led technological, intelligence, and operational teams in the IDF’s elite Unit 8200, received his master’s degree at MIT, delivers guest lectures there, and was an associate partner at McKinsey & Company.

Simha, in addition to serving as Shimon Peres’s technical advisor, was a senior executive in a UK-based hedge fund founded by Sir Ronald Cohen, and chairs the committee that selects the most promising start-ups which exhibit at the Peres Center for Peace and Innovation in Tel Aviv.

“We select companies through a lot of internal dialogue,” explains Argov. “We invest in companies with a demonstrated product-market fit. They must have a product that is relevant for its market, and that market must be large enough.”

The New Era team scrutinizes the company’s technology to ensure that it is robust and well suited to the company’s mission. But the most important thing in evaluating a company, he says, is the quality of its leadership team. “We spend an enormous amount of time vetting the teams, talking to them, getting references, understanding if they have the experience and judgment to build a successful organization, and the resilience and creativity to change course without getting lost and without destroying the organization.”

Adds Simha, “At the end of the day, we are looking for companies that address an existing problem and market need. We need to see that there is a real, visible problem with a large enough total addressable market for which individuals or companies would pay money for their solution.”

After New Era has invested in a company, it offers assistance as needed. Conen explains, “We are hands-on, high-touch investors. We recognize we are not management, but we are there when they want us, throughout the investment.” Conen also notes that New Era assists companies in several ways – connecting them to customers and potential talent, helping in strategic problem-solving, and making connections with additional investors.

Argov explains that the current economic crisis has caused dramatic changes in the financial conditions for venture capital funds. “It’s like night and day – it’s as if someone turned off the lights,” he says. “It has been a series of effects. There was essentially a zero cost of capital for a long time, which fueled a massive inflationary bubble in the valuation of most asset classes, including venture capital.” Since then, rates have gone up, inflation has gone up, and public company values are down, which quickly translates to private markets.

Despite that, both Simha and Argov say that today’s economic climate presents unique opportunities and challenges for Israeli start-ups. “I see it as an opportunity for Israeli start-ups and entrepreneurs,” says Simha. “Because the world is evolving towards artificial intelligence, machine learning and automation as a whole, Israeli founders have both the skills and experience to tackle these issues and can lead the way to get out of the current global crisis,” he concludes.

Paradoxically, he notes that today’s unstable economic environment can help companies focus their attention on addressing significant problems rather than niche solutions.“We are in an environment with higher interest rates, and debt financing is not as available as it was in the past, but talent is easier to hire because more companies are reducing the number of employees,” says Simha.

“On the one hand, it is an opportunity.” Still, he cautions that “companies need to think carefully how to deploy raised capital to have a sufficient runway for the next few years and not find themselves trying to raise funds in a more difficult environment.”

Argov states that despite the current crisis, Israeli entrepreneurs are uniquely qualified to survive. “I would rather be working with and invest in companies run by Israeli entrepreneurs at such a time than any other kind of entrepreneur,” he says. “It goes back to the basic societal realities in Israel. In many cases, the people we invest with were officers in the IDF, in units like 8200 or in technical programs such as Talpiot. As a result, they are equipped to make decisions in an environment of uncertainty, as well as improvise, while not losing sight of the core mission and capabilities of their enterprise and their team. When interacting with these founders, one senses a laser-sharp focus on the task at hand, coupled with an ability to learn and evolve as conditions in the market shift. It’s that initiative and leadership that is different than any other place. Needless to say, it is fun and invigorating to be able to play a role in helping such leaders to accomplish their vision.”

Ultimately, says Simha, New Era’s success is dependent on the success of the companies in their portfolio. “The success of our companies and their founders and CEOs and entrepreneurs is what makes us successful. They do the real work and build the company.”

It is for that reason, he explains, that New Era is launching its podcast series in conjunction with The Jerusalem Post. “We want to share the experience and knowledge of our entrepreneurs with the rest of the community and ecosystem. Our podcasts will feature select CEOs who will share their experiences of what they have faced in the past few years and what they are doing to adjust to today’s environment.”

No Limits: A New Era of Start-ups

New Era Capital Partners and The Jerusalem Post have launched a six-part podcast series featuring in-depth interviews with CEOs of Israeli start-ups who share the experiences and challenges of developing successful companies in today’s fast-paced and demanding business environment.

Episode #1 of No Limits – featuring Tamar Uriel-Beeri, managing editor of Jpost.com, and Gideon Argov, managing partner and co-founder of New Era Capital Partners, in conversation with Amos Haggiag, CEO and co-founder of Optibus – is now available.

Optibus has created the first complete operating system of software to control fleets of public transportation vehicles around the world. Future episodes will appear each month.

This article was written in cooperation with New Era Capital Partners.