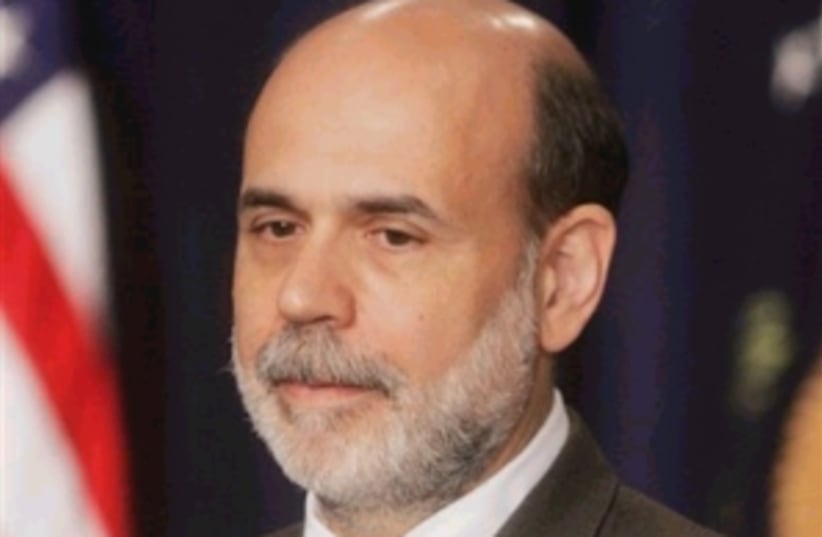

Several million words have already been devoted to the appointment of Ben Bernanke as the new chairman, and what this might mean to US monetary policy and hence to the American economy and hence to the global economy - and hence to the man or woman on the street, whether in Peoria, Petah Tikva or Penang. This is a mere drop in the ocean compared to the billions of words written about Greenspan during his 18-year tenure as the head of America's central bank - but hey, it's a start.

The assumption underlying the obsessive interest displayed by the financial world in the Federal Reserve Bank, its head and policy, is that the chairman of the Fed is "the second most powerful man in America" - after the president, but ahead of the chief justice of the Supreme Court. This power stems from the ability of the Fed - in practice, of its chairman - to determine monetary policy (ordinary people read "interest rates").

This assumption has become so universally accepted that anyone questioning it must be suspected of latent communist sympathies or of being retarded. Nevertheless, we will raise two initial points with regard to the Fed and to monetary policy in general: first, it is reactive. Indeed, under Greenspan, this became a fundamental doctrine; the fierce argument that has raged for the past 10 years regarding the Fed's failure to prick the stock market bubble of the late 1990s, and its current hesitancy in addressing the real estate bubble, is focused on the validity or otherwise of Greenspan's view that the Fed should not prick bubbles, but react to their aftermath.

Second, monetary policy - which is what central banks engage in - is only one aspect of economic policy. Worse, it is a very short-term element. The prominence it has received in the last generation is the result of the failure of central bankers in the 1960s and 1970s, and the resultant worldwide inflation. This led to the rise of the new dogma of "stability" as the sine qua non for economic development, and the crowning of central bankers as the high priests of the new religion, whose jihad was and remains fighting inflation.

Yet there are worse diseases in the economic lexicon than inflation. As the Japanese can testify, deflation is certainly one - and it also belongs to the monetary policy complex.

The changing of the guard at the Fed is an opportunity for second thoughts on the usefulness of the obsessive focus on monetary policy and, by extension, on the dominance of monetarist economics and its belief that money is the critical factor in economic policy-making. As soon as you move beyond the fixation with what the Fed will do at its next meeting, the very limited capability of monetary policy becomes apparent. Here are a few examples, from areas currently in the news:

What moves the world are, almost exclusively, long-term trends in demographics, social behavior and technology. What moves markets on a daily, hourly and minute-to-minute basis are the words and decisions of central bankers.

landaup@netvision.net.il

| More about: | Alan Greenspan, Ben Bernanke, World Trade Organization, General Motors |