Gasoline and electricity prices are set to rise on Tuesday, reflecting global price hikes brought on in part by supply shortages, steeper raw-material costs and decreased workforce availability.

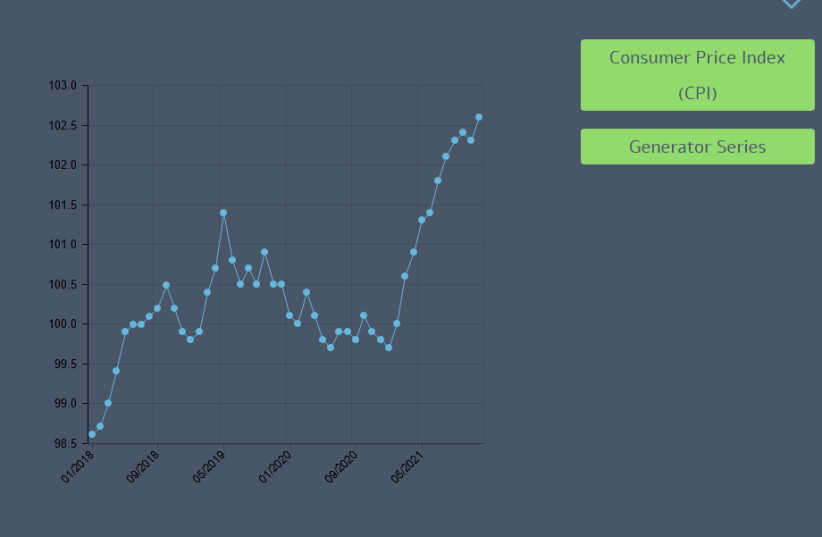

Israel’s Consumer Price Index (CPI) rose 2.8% in 2021 and increased another 0.1% to 2.9% this year as of January 30, the Central Bureau of Statistics reported Monday.

Prices for products and services are rising throughout the country. Last month, Osem, one of Israel’s largest food producers, told supermarkets it would be increasing the prices of its products by as much as 5%, citing an increase in the cost of materials, packaging and transportation.

“This is unprecedented,” Osem said. “After an extended period during which we have absorbed the price increase, we are forced to update our retail prices.”

The cost of gasoline has spiked in tandem with the increased price of oil on global markets. The maximum price of 95-octane gasoline is set to rise by NIS 0.34 to NIS 6.71 per liter on February 1 at midnight, the Energy Ministry said. The price of one barrel of Brent crude oil is currently $91.31. Over the past week, it has risen $4.61, or more than 5%.

Electricity tariffs are set to rise an average of 5.7% on February 1 at midnight, the Public Utilities Authority said. It attributed the increase to an almost tripling of world coal prices, from $86 per ton to $226 per ton in the past year.

The rise in energy prices has led to a significant increase in electricity tariffs in many countries, the Public Utilities Authority said. More severely impacted are Sweden, with a 35% rise, the UK (34%), Belgium (18%) and Austria (14%).

Israel, in part due to its reduction of coal use in recent years, is among the countries with lower increases, including the Czech Republic (9%), Italy (6%) and Germany (5%).

While supply issues and raw-material costs are partly to blame, the coronavirus pandemic’s effect on consumer demand also plays a significant role in the CPI’s increase, according to Prof. Danit Ein-Gar of Tel Aviv University’s Coller School of Management.

“There are two trends [at play] on the side of demand,” she said.

“The short-term trend is that there are people in desperate need of escapism and compensation during these last two years,” she said, and there may be a rise in “compensation consumption,” meaning that people splurge on pricey goods as a means of distracting themselves from the dour conditions brought on by the pandemic. Those expensive self-care treats may lead to a higher tolerance threshold, which could enable even steeper price increases, she added.

Consumers may be able to rationalize spending in the short term, but the situation may not last for long, Ein-Gar said.

“The long-term trend is that there are more and more people entering the low-income segment – people losing their jobs, people who invested in small businesses that went bankrupt, people getting sick,” she said. “You have a much larger population with less money to spend on pricey products.”

In situations like this, a breaking point exists that spurs pushback from the public as the cost of living rises beyond a tolerable level, Ein-Gar said.

“That’s where revolution starts,” she said. “People start saying, ‘We can’t live like this anymore,’ and protesting, which can swing the government.”

As Israel’s CPI rises partly as a result of pandemic-induced consumer trends, so does the country’s savings. According to the Taub Center’s 2021 State of the Nation Report, high restrictions on areas where contagion is a heavy risk led to consumers saving more money, contributing to an increase of about 8.5% in gross private savings.

Regarding Israel’s rising prices, Avi Weiss, the report’s editor and co-author, suggested that things may not be as concerning as they seem at first glance.

“It’s not so significant,” he said. “Prices in Israel went up 2.8%, but in the US and most of Europe, it went up a lot more than that. Israel got a relatively minor shock compared to other countries. We don’t know what will happen – maybe it’ll keep going up. But [the increased CPI] in 2021 is not something specifically important.”

A 2.8% increase keeps the country comfortably within the Bank of Israel’s projected 1%-3% target inflation range, Weiss said.

“For more than half a decade, since 2015, we’ve been within the Bank of Israel’s window,” he said. “We’ve had [practically] zero inflation,” so “to suddenly hit 2.8% in a single year, it’s not something that people should be getting excited about.”