The major US stock indices – S&P 500, Nasdaq, and Dow Jones – enjoyed a few months of unrestrained growth. They all renewed their all-time highs and seemed poised to sustain the momentum. However, in mid-February, these indices synchronously decreased. Let’s delve into the reasons behind this shift and why it warrants our attention.

First, let’s take a glance at Wall Street’s main indices over the last couple of months. The observation reveals the remarkable success of US stocks during this period. Additionally, for insight into today's top performers, one can consult the list of market movers in the US market.

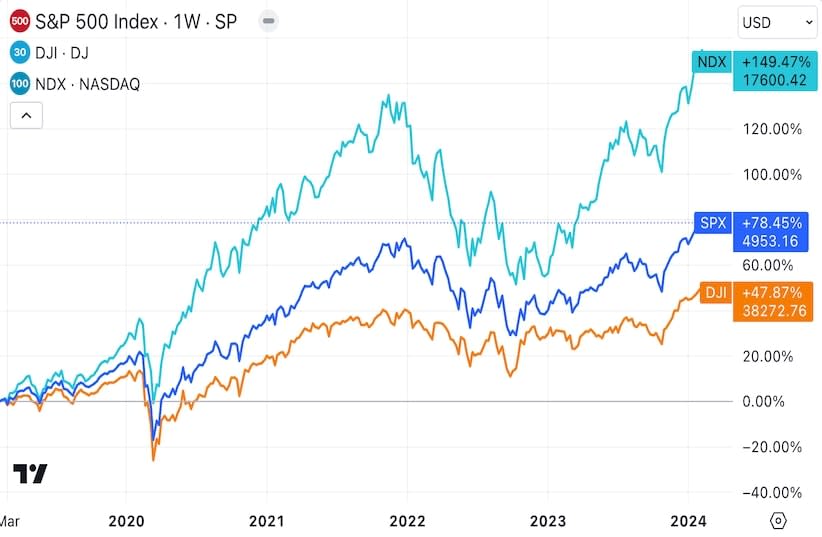

Taking a broader period, such as the last five years, allows us to see a simultaneous spike that began in the second half of 2023.

The growth of indices is attributed to two main factors – expectations surrounding the Fed’s policy and the hype around AI technology. Both of them are easy to explain.

When market participants anticipate the Federal Reserve initiating a tapering cycle soon, the US dollar and US bonds lose some appeal for investors, consequently shining the spotlight on stocks.

Artificial intelligence developments dominated the stock markets in 2023 (and perhaps will continue into 2024). All big techs got into this AI race. In other words, AI propels their stocks, which in turn bolsters the indices.

While these principles seem straightforward, one of them was disrupted in February. The release of inflation data revealed that consumer inflation surpassed expectations, potentially delaying the anticipated moment when the Fed would cut interest rates for the first time. Before the release of the report, experts believed the regulator might start the new cycle as early as May. Now, June is mentioned more often.

Could this decline be a short-term and insignificant phenomenon? Of course. However, it's important to understand that the less certainty investors have regarding the Fed's forthcoming actions, the greater pressure on the stock indices is.

Meanwhile, market conditions evolve rapidly, sometimes on a weekly or even daily basis. Therefore, it's imperative to stay abreast of all significant news, conduct your own analysis, and remain prepared for any changes. Only then should investment decisions be made.