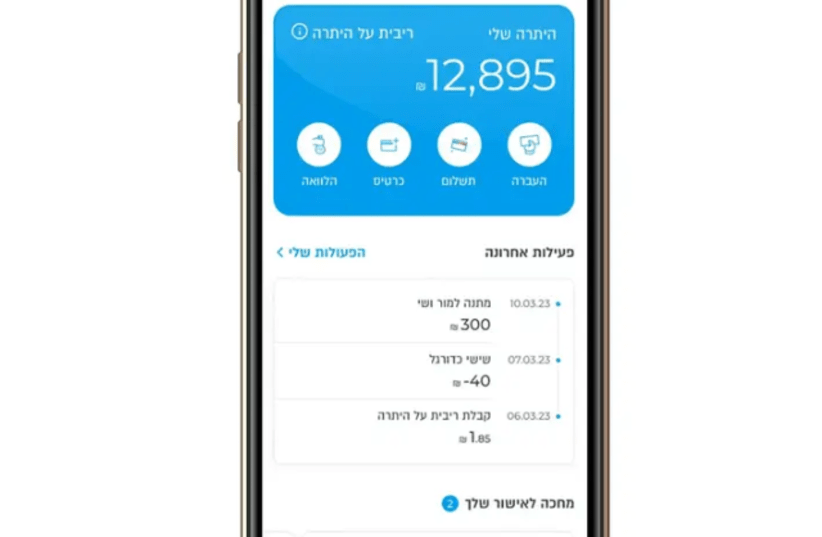

Finally, it is possible to earn interest on the money "lying in current accounts": Paybox announced that it will pay customers 3% interest on their balance, without the need to close the account. As part of the service, Paybox users will earn interest on their personal balance, which will remain available to them for withdrawal, transfer, or payment at any time and without cost.

The interest will be granted to all Paybox credit card holders from all banks.

New joiners will be able to get the free and digital card (without lifetime card fees) directly from the app, and start depositing money to their balance and earning interest on it.

In the initial stage, due to regulatory limitations, it will be possible to hold a balance of up to 20,000 shekels, which will increase in the future. The interest will accrue daily and be paid monthly directly to the Paybox balance.

The service will be available in the app and will be available to all customers. This current process is an additional and most significant step in transforming Paybox from an app for transfers and collective money collection to an app for managing money outside of banks, posing significant competition to the banking system and offering superior products and services compared to those offered by banks.

The process, which began about a year ago with the proposal of a lifetime fee-free credit card, continued with the offer of a deposit (monthly) at double the average interest rate offered by banks (a deposit that attracted thousands of depositors who deposited over 145 million shekels within 3 weeks), and now continues with interest payment on the balance.

Erik Frischman, CEO of PayBox: "The move we launched today breaks the banking consensus that 'no interest is earned on idle money for the public' and creates a real alternative to the half a trillion shekels currently lying in foreign bank accounts, generating massive profits for the banks and giving nothing to the public. From today, customers of all banks will be able to transfer this money to PayBox, keep it liquid, and earn a reasonable interest on it. This is another significant contribution to turning PayBox into a true competitor to the banks, aligning with the spirit of the times, where the public is seeking every way to increase their disposable income."

PayBox is an app for transferring money between individuals and group collection of funds, with over 3.5 million downloads and more than 1 million different users per month.

PayBox customers can perform a wide range of actions, including: holding balances separate from their bank account, paying with these balances anywhere using a free digital credit card, transferring and receiving money, setting up groups for collective fundraising, accumulating and redeeming Supreme benefits (Shopersal's loyalty program) across more than 100 networks, attaching and redeeming gold card purchases from Shupersal, and more.

PayBox was founded in 2014 as a startup and is now an independent banking corporation, owned by Discount Bank (50.1%) and Shupersal (49.9%).

PayBox is managed by Erik Frischman, and the chairman of the company is Uri Levine, the former CEO of Discount Bank.