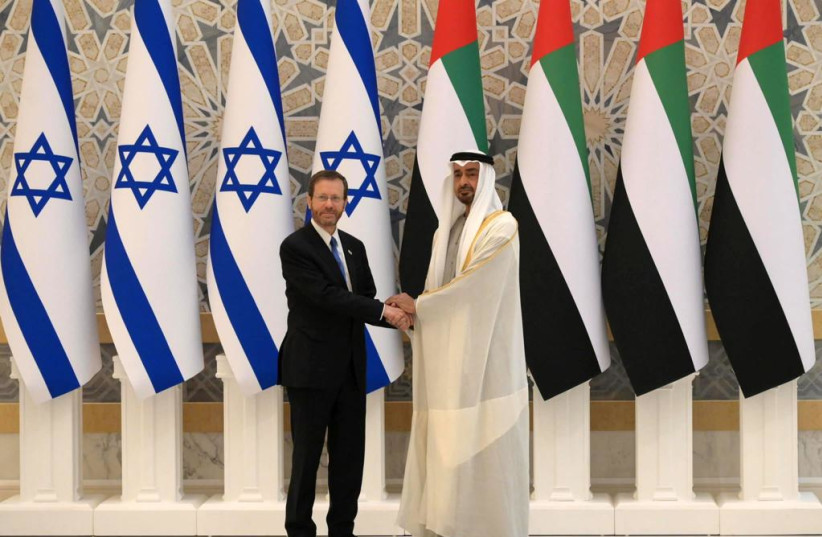

The biggest news from Israeli President Isaac Herzog's visit to the United Arab Emirates was not to do with diplomacy or defense but rather the huge sums that Abu Dhabi plans to invest in Israel.

Sources close to the matter have told Globes that UAE Crown Prince Mohamed bin Zayed has decided to unfreeze the $10 billion in investments in Israeli companies that he promised former prime minister Benjamin Netanyahu. The UAE's large sovereign funds will divide the investments between them, including the ADIA Fund and the Mubadala Fund, although the first fund that will enter the Israeli market is the ADG (Abu Dhabi Growth) Fund, part of the ADQ Group. This fund plans investing $200 million in 2022 in Israeli companies, and a similar sum each year over 10 years.

A senior source in the UAE told Globes that Abu Dhabi has been waiting patiently for the Israeli political scene to stabilize before renewing the process of fulfilling bin Zayed's promise. Herzog's visit, personal, diplomatic but not political, meant that he was the right person at the right time to officially start the investment process.

ADG Fund chairman Faris Mohammed Al Mazrouei met with several members of the small Israeli delegation that accompanied President Herzog. At meetings in Abu Dhabi, the Israelis and Emiratis spoke about the mechanisms for the investment and how organizations like the Manufacturers Association of Israel and the Israel Export Institute would help direct the investments.

Another important link in the chain will be Start-Up National Central, which in recent years has specialized in matching up Israeli startups with investors. Start-Up National Central CEO Avi Hasson, who traveled to the UAE as part of President Herzog's delegation, told "Globes" that the unfreezing of the $10 billion by the UAE for investment in Israel was highly significant for both countries. He said that the Emirati use the investment funds as a strategic tool and are expressing through the funds the importance with which they see relations with Israel.

Hasson thinks that Israel is perceived by the Emirati as a symbol of innovation and progress due to the companies located here, and therefore it represents a good investment. "This is not philanthropy or a political investment fund," he said. "The Emirati are seeking profits from their investments. We do not have a commercial agenda but extensive knowhow of the abilities in the advanced technology sector and the ability to connect Israeli companies with the precise needs of investors."

Hasson stressed there has to be a match between the Israeli "here and now" approach and the slower UAE approach of first building trust through a genuine connection between the parties and only then moving forward.