Contract chipmaker Tower Semiconductor topped second-quarter revenue estimates on Wednesday on the back of solid demand from the automotive industry, sending its US-listed shares up 12.7%.

The company - which caters to "fabless" firms that design chips but outsource manufacturing - is set to be bought by Intel under a $5.4 billion deal that was announced last year.

Demand from the automotive industry has emerged as a bright spot for the chip industry at a time other clients are cutting back on orders, as carmakers had faced a severe semiconductor shortage over the past two years and their supply chains have only started normalizing in 2023.

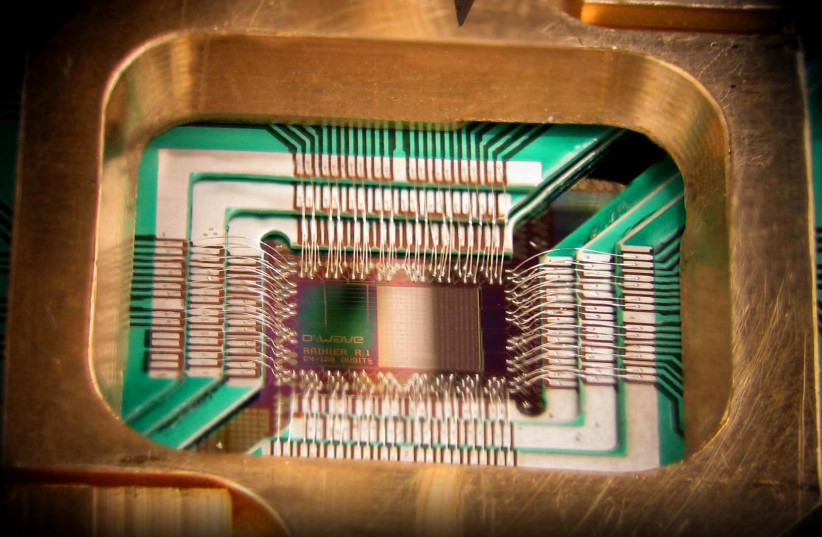

Israel-based Tower provides customers with analog and mixed-signal semiconductors, mainly for the automotive and consumer industries.

Tower's growing revenue

Its revenue came in at $357 million for the quarter ended June 30, higher than the $354.53 million expected by analysts, according to Refinitiv data.

Tower reported net income per share of 46 cents, falling slightly short of analysts' estimates of 49 cents per share.

During the quarter, the company repaid $10 million of its debt, as compared with $27 million in the first quarter of 2023.