The stock market may seem too risky in times of crisis, and that is a reasonable conclusion to draw. But there are always stocks and industries that thrive in tough times – like online services during the Covid-19 pandemic. Walmart's stock could potentially be such an example in a possible recession. Let's try to figure out why analysts believe in this company.

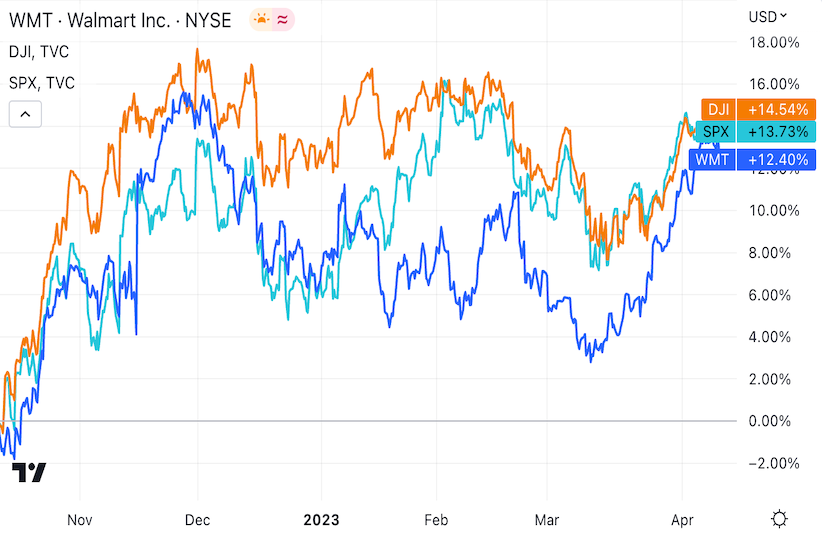

Walmart's stock is up 13% in the last six months. It’s a pretty good result when we have crises around the world and complicated geopolitical affairs.

Let's add a few popular indices to the chart - the Dow Jones Index and the S&P 500 Index. The comparison surprisingly shows that they have roughly the same performance as Walmart. The crisis, as well as planned economic events, can affect the markets. The economic calendar can be used to predict how trends will change. This is a useful tool for every trader and investor.

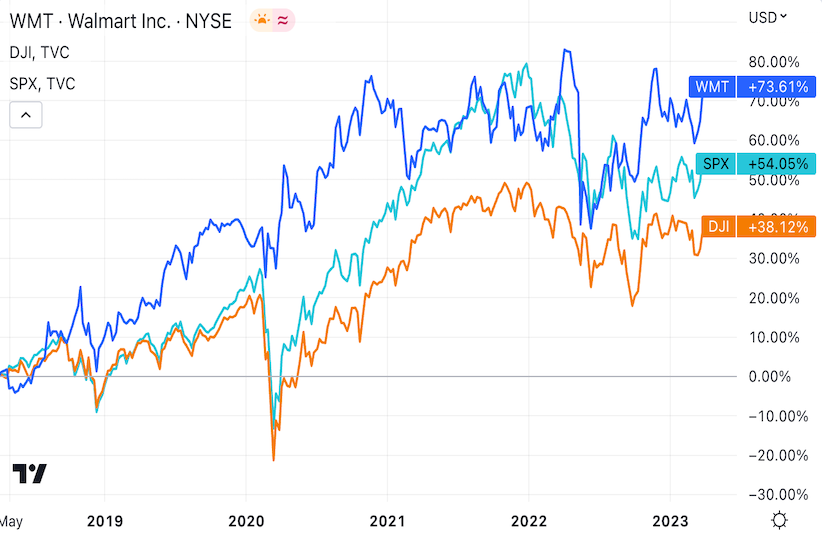

If you look at it from a broader perspective, you can see the difference in the performance of Walmart stock and the major indices – the stock is clearly winning. This fact gives investors and experts an opportunity to consider Walmart stock as a reliable long-term investment capable of beating the market.

Why is Walmart’s stock able to rise even in a recession? The answer is fairly simple. In crises, people have less money. And Walmart is a chain of budget stores, whose products are available to many people. Plus, the company always tries to keep prices as low as possible. So, it’s a perfect combination – people are more likely to choose low-price supermarkets when times are tough.

Another competitive advantage of Walmart is its subscription service, Walmart+. It includes such benefits as free delivery, access to Paramount+ video streaming, discounts at gas stations, and more. What’s more important is that Walmart+ is cheaper than competitors like Amazon.

In addition, Walmart is investing in the development of process automation and even artificial intelligence technology. These investments are intended to reduce the wage bill in the future (and yes, this means that the number of jobs will eventually decrease as well – at the least, for humans). An additional positive aspect for long-term investors is the dividends that Walmart pays regularly, and their increases.

Analysts believe that Walmart stock could be a solid investment. The consensus forecast is +10% over the next 12 months. Not bad at all for a recessionary period. Better than analysts' opinions, however, is doing your own analysis before every trade. This is the only way to achieve real success in the stock markets.