In Sydney’s hot property market, securing a mortgage is one of the biggest steps in the journey of buying a home. This process can often be overwhelming, with a ton of options, differing interest rates, and complex terms and conditions. This is where the expertise of a mortgage broker becomes invaluable. A great mortgage broker not only simplifies this process but also tailors it to fit your unique financial circumstances, saving you time and money.

In this article, we take a look at Sydney mortgage brokers, highlighting the best professionals in the field. Our guide will provide you with essential insights into what makes a top mortgage broker, and how to choose one that best aligns with your goals when buying a home. Whether you're a first homebuyer or an experienced property investor, understanding the role of these financial experts is key to making informed decisions in Sydney's dynamic property market.

The Top Mortgage Brokers in Sydney

#1. Shaun Bettman - Principal Mortgages

Credit: Principal Mortgages

Located in the heart of Sydney, Principal Mortgages was founded in 2004 by Shaun Bettman, a highly qualified Chartered Accountant with a vision to revolutionise the mortgage brokerage industry. For two decades, Shaun and his team of expert brokers have been steadfast in their commitment to securing the best rates and terms for their clients, solidifying their position as a leading mortgage broker in Sydney.

Principal Mortgages distinguishes itself through its innovative approach to mortgage broking. The company leverages a network of over 40 lenders, coupled with advanced software analysis, to ensure a comprehensive evaluation of loans and terms. This meticulous process guarantees that every available option is explored, leaving no stone unturned. In a market where a significant number of young Australians feel daunted by the prospect of homeownership, having a forward-thinking broker like Shaun Bettman can be a game-changer.

Shaun's expertise extends beyond his prowess in accounting; his extensive network, built over two decades, enables Principal Mortgages to offer clients exclusive loan options that may not be readily accessible to the general public. This access is a critical advantage for clients, especially those who are self-employed or seeking specialised loan products.

Key highlights of Principal Mortgages include:

- Shaun Bettman's qualifications as a highly skilled Chartered Accountant.

- An impressive 99.2% loan approval rate.

- Specialisation in loans for self-employed individuals.

- Ability to negotiate interest rates that are not publicly available.

- Industry-leading turnaround times.

- An outstanding 5-star rating on Google reviews based on 118 clients.

In his commitment to transparency and client empowerment, Shaun Bettman offers a free loan calculator on the Principal Mortgages website. This tool allows potential clients to assess their financial position before initiating contact, demonstrating the firm's client-first approach.

Principal Mortgages' philosophy extends to considering non-traditional lenders and working with clients regardless of their income stream, showcasing their flexibility and client-centric approach. Having worked with over 1,000 satisfied customers and securing over $500,000,000 in loans, Principal Mortgages has established a solid track record of success.

In summary, with Principal Mortgages, clients benefit from not just Shaun Bettman's experience and expertise but also from the firm's innovative and adaptable approach to mortgage broking. Whether you're navigating the property market for the first time or looking for a tailored loan solution, Principal Mortgages offers the expertise, network, and innovative solutions to meet diverse mortgage needs in Sydney.

Visit Principal Mortgages Website

#2. Mansour Soltani - Soren Financial

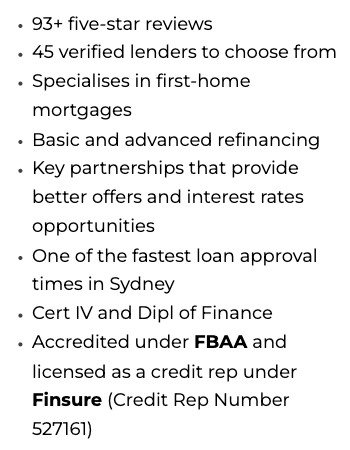

Mansour Soltani at Soren Financial stands out as the #2 mortgage broker in Sydney, thanks to his extensive experience, wide range of lender options, and a commitment to personalised service. Here’s why he is highly regarded in the industry:

Vast Selection of Lenders: Mansour Soltani offers his clients a choice of 45 verified lenders. This extensive network ensures clients have access to a broad range of mortgage products, allowing them to find the most suitable loan for their specific needs.

Specialisation in First-Home Mortgages: Soltani has a particular expertise in assisting first-home buyers. His in-depth understanding of the complexities and challenges faced by new buyers enables him to provide tailored advice and support, helping them navigate the often-daunting process of securing their first mortgage.

Expertise in Refinancing: Whether it's basic or advanced refinancing, Soltani’s expertise ensures clients can restructure their loans efficiently, potentially saving significant amounts of money and time.

Beneficial Partnerships: His key partnerships with various lenders allow Soltani to offer his clients better deals, including competitive interest rates and favourable loan terms. These partnerships are a testament to his reputation and negotiating prowess in the industry.

Rapid Loan Approval: Soren Financial, under Soltani's guidance, boasts one of the fastest loan approval times in Sydney. This efficiency is crucial for clients, especially in a competitive property market.

Professional Qualifications and Accreditation: Soltani’s professionalism is backed by his Cert IV and Diploma of Finance, along with accreditation under the FBAA. As a licensed credit representative under Finsure, he adheres to the highest industry standards.

Client-Centric Approach: At Soren Financial, the focus is on providing a bespoke client experience. This approach is evident in their 5-point approval process, which includes understanding long-term financial goals, comprehensive lender assessment, real-time loan matching, detailed analysis of the top 5 loan options, and providing a full home loan report – often within 24 hours.

Long-Term Client Relationships: Soltani’s approach to building and maintaining long-term relationships with clients and lenders alike has contributed to his reputation as one of Sydney’s best mortgage brokers.

Mansour Soltani’s combination of extensive lender options, specialisation in first-home mortgages, efficient refinancing skills, and a client-focused approach make him a top choice for anyone looking to navigate the property market in Sydney. Whether you are a first-time homebuyer or looking to refinance, Soltani’s expertise and the innovative approach of Soren Financial make them a go-to for mortgage advice and services.

#3. Justin Doobov - Intelligent Finance

Intelligent Finance, led by the highly acclaimed mortgage broker Justin Doobov, has established itself as a standout mortgage broking firm in Sydney, gaining recognition across Australia for its exceptional service and performance. In the financial year 2021, Justin Doobov achieved a remarkable feat, setting a record on the MPA Top 100 Brokers list by writing an impressive $423 million in home loans. This achievement not only underscores his expertise in the field but also cements Intelligent Finance's position as a leading player in the mortgage industry.

The team at Intelligent Finance is particularly renowned for their adeptness in handling complex lending scenarios. They excel in crafting lending solutions tailored to the unique needs of diverse client groups. This includes self-employed borrowers who may face challenges in traditional loan processes, property investors looking for competitive financing options, and individuals with distinct financial situations that require a more nuanced approach.

A hallmark of Intelligent Finance’s service is the personalised attention and advice they provide to each client. They place a strong emphasis on ensuring that clients are thoroughly informed and comfortable with every aspect of the lending process. From understanding loan terms to navigating the intricacies of mortgage applications, Justin and his team ensure a seamless, transparent, and supportive experience.

This dedication to client-centric service, combined with their expertise in complex lending situations, makes Intelligent Finance a go-to choice for those seeking mortgage solutions in Sydney. Whether it's for purchasing a new home, investing in property, or finding unique financing options, Intelligent Finance stands out for its ability to deliver tailored solutions and expert guidance in the ever-evolving world of mortgage lending.

#4. Christian Stevens - Shore Financial

Christian Stevens from Shore Financial stands out in Sydney's mortgage broking landscape, not just for his impressive six-year track record of accolades but for his deep-seated commitment to assisting first-time homebuyers. His dedication extends beyond traditional broking roles; he founded Australia's largest Facebook group for first-time buyers and holds the title of the most viewed mortgage broker on LinkedIn nationally. This level of engagement and recognition underscores his passion and expertise in guiding new buyers through their journey to homeownership.

Christian's approach at Shore Financial is especially tailored for those taking their initial steps in the property market. He tirelessly shares insights and advice, focusing on helping clients transition from renting to owning. His efforts are driven by a genuine desire to see clients achieve the financial benefits of homeownership. For those navigating the Sydney property market, particularly first-time buyers, partnering with Christian means engaging with a broker who is as invested in realising their dreams as they are.

#5. Greg Bloom - 1st Street Financial

Greg Bloom, a seasoned professional at 1st Street Financial, boasts a rich background in finance and real estate since 2008, beginning with his education at the University of Witwatersrand and the University of South Africa. His career journey, from auditing to managing Yellow Brick Road's Bondi office in wealth management, has culminated in his current role since 2017, where he excels in mortgage brokering. As a Chartered Accountant well-versed in finance and wealth management, Greg brings a unique blend of expertise and understanding of the vast Australian mortgage market, skillfully assisting individuals to secure mortgage terms tailored to their needs. His decade-plus experience in Sydney, building robust client and lender relationships, makes him a standout choice for navigating the complexities of mortgage loans.

The Role of Mortgage Brokers

Mortgage brokers play a crucial intermediary role in the property market, acting as a bridge between potential homebuyers and lenders. Their primary function is to understand the client's financial situation and requirements, and then scour the mortgage market to find a loan that best suits these needs. This involves comparing various loan products from different lenders, which can range from major banks to smaller credit unions and other financial institutions.

In a market as competitive and diverse as Sydney's, the expertise of a mortgage broker can be particularly beneficial. One key advantage is the access they provide to a broader range of loan options than a potential buyer might find independently. This is because some lenders only work through brokers, offering loan products that are not directly available to the public.

Furthermore, mortgage brokers in Sydney are adept at navigating the complexities of the local property market. They can offer invaluable advice on loan features, interest rates, repayment schedules, and any hidden costs associated with the mortgage. This expertise is particularly beneficial in tailoring loan solutions to meet specific needs, such as for first-time homebuyers, investors, or those refinancing existing loans. By leveraging their knowledge and network, mortgage brokers can save clients considerable time, stress and money.

Criteria for Choosing the Best Mortgage Broker

Selecting the best mortgage broker in Sydney involves careful consideration of several key factors. Firstly, experience is paramount. An experienced broker not only brings a wealth of knowledge about the mortgage market but also has a deeper understanding of navigating complex financial scenarios.They are more likely to have dealt with a variety of client situations and can provide guidance based on a proven track record.

The breadth of a broker’s lender network is another crucial aspect. A broker with a wide network can offer you more options, ensuring you have access to the best possible loan products that suit your specific needs. This variety can make a significant difference in terms of loan features and interest rates.

Client testimonials and reviews are invaluable for gauging a broker’s reputation and the satisfaction level of their past clients. Positive feedback and success stories are strong indicators of reliability and quality service.

Understanding the fee structure is also important. Clarify how the broker gets paid – whether it’s through lender commissions or direct client fees. A transparent fee structure is a sign of a trustworthy broker.

Lastly, consider the range of services offered. Some brokers might provide additional services like financial advice or support in loan application and settlement processes. A broker who offers comprehensive services can simplify the entire home-buying journey for you.

Tips for Working with a Mortgage Broker

To optimise your experience with a mortgage broker, clear and open communication is key. Start by articulating your financial goals, concerns, and expectations. Providing detailed information about your financial situation, including income, debts, and credit history will enable the broker to find the most suitable mortgage options for you.

It's important to ask questions. Don't hesitate to inquire about different loan types, terms, rates, and any fees involved. Understanding these elements ensures you are well-informed to make the best decision. Also, be proactive in seeking clarification on any aspect of the mortgage process that is unclear to you.

A common mistake is not exploring enough options. Encourage your broker to present a variety of loan products. This will give you a broader perspective and help you make a more informed choice.

Finally, remember that the broker works for you. While they offer expertise and advice, the final decision should always align with your comfort and financial objectives. Trust your judgement and ensure that the chosen mortgage aligns with your long-term financial plan.

Conclusion

Selecting the right mortgage broker in Sydney is a crucial step in your home-buying journey. A good broker can significantly simplify the mortgage process, offering expert guidance tailored to your financial situation. It's essential to conduct thorough research, considering factors such as experience, lender network, client feedback, and the range of services offered. Remember, the ideal broker should not only have the expertise but also align with your specific needs and financial goals. Take the time to find a broker who you can trust and who understands your vision for homeownership, as this choice can profoundly impact your financial future.

This is a sponsored article. The article should not be considered as advice.