'Buy the rumor, sell the fact" is one of the best-known marketadages. Act on the expectation, the assumption, the possibility. Then,when whatever it is you expected to happen actually materializes andthe thundering herd of investors jumps on the bandwagon - that's thetime to get off. This is impeccable market logic, it works in bothdirections - i.e. for both positive and negative expectations, rumorsand facts, and if followed consistently, it generates good results.

The reason most people don't apply this maxim and act by it isbecause, despite all the advantages, it requires exceptional courageand determination to actually do it. That is somewhat true for stageone, which is buying on the rumor, but there at least you can be buoyedby your conviction that you are doing the right thing and, hey, you'resmarter than the rest of the pack. But selling on the fact - that'svery difficult. The share, or the market, or whatever it is you boughtis now delivering the goods. It's steaming ahead, and you are raking inprofits. Everyone else - the dummies who were not smart like you - ispiling in. To sell out now, to go against the crowd, that's reallydifficult.

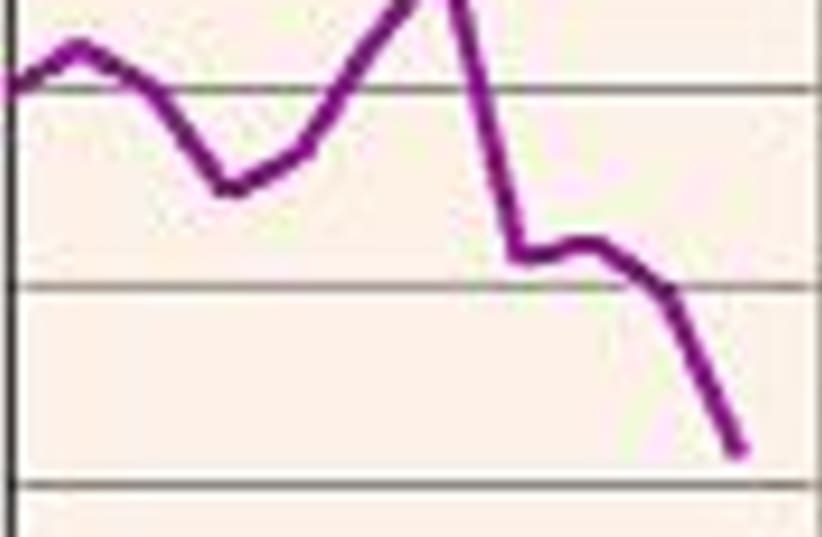

Given these general remarks, what is one to make of theactivity across the financial markets over the last several days,especially Wednesday and Thursday of this week, when they sold offheavily? In the US, the news has been mixed, but leaning in thepositive direction: many of the big companies announcing their 2009results in recent days have 'exceeded analysts' expectations' (this ismeaningless drivel, but that's what the headlines blare, so people areinfluenced by it). Yet the US equity markets have suffered theirheaviest two-day sell-off in months and are looking ripe for furtherdeclines.

Over in China, data published this week show the economy backon the path of rapid growth, with the slump of late 2008-early 2009fading into memory. Yet the Chinese stock market has dropped, whilstthe market in Hong Kong - most people's entry point into Chineseequities - has fallen by some eight percent over the last week or so.

The most obvious explanation would be that people are sellingthe fact - of positive results at either the corporate or macro levels- and taking profits, after having earlier bought the expectations andpredictions of these items of good news. But even if this explains thesudden reversal from strength to weakness in equity markets, it doesnot explain the much more dramatic falls in the prices of precious andbase metals, nor the rapid rise of the dollar against most other majorcurrencies - except, significantly, the yen.

It may well be, therefore, that people are selling a differentfact - not good news, but bad news. The official bad news came fromChina, in the form of indications and then actions that showed that theChinese government is now alarmed by the success of its ownexpansionary policies and stimulus programs. It was these thatgenerated the rapid return to rapid growth during 2009 - but the gameof throwing money at banks and ordering them to lend it to whomeverthey could find has gotten out of hand. In the first two weeks ofJanuary, Chinese banks lent out 1-1.5 trillion yuan (about $150-200billion worth) and this seems to have triggered a clampdown.

In China, clampdown means clampdown. They don't use nods andwinks, like the British, nor do they rely on open market operationslike the Americans. The regulator called in some top bankers and toldthem to stop lending, period. That is a fact worth selling, because itwas the massive Chinese stimulus last year - by far the biggest,relative to the size of the economy - that fuelled the building boomand house price inflation in China. That money, together with the hugefunds made available by the central banks of developed countries, hascaused equity prices to soar around the world and has driven the pricesof most commodities to huge gains during 2009.

The Chinese central bank is now reversing course. Others arelikely to follow - the Federal Reserve is already winding down itsemergency liquidity programs. The removal of liquidity may have asgreat an impact as its introduction, or even worse. Smart people arenot waiting around to find out.

landaup@netvision.net.il