Best Gold IRA Companies in 2022

Editorial Note: This page contains ads and affiliate links. Commissions do not affect our editors’ opinions or evaluations.

When you’re looking at your investments, you don’t want to put all of your eggs in one basket. That’s where portfolio diversification comes in. Most of the retirement vehicle options like a 401 (k), a 403(b), and a 457 invest the funds in traditional financial assets like debt and equity. And while those are excellent ways to get those types of exposure, there is a non-traditional IRA - the Gold IRA - that can help you get your precious metals exposure to be truly diversified overall. A Gold IRA allows direct physical investment in precious metals like gold, silver, and platinum.

In this article, we will cover things like:

- How Gold IRAs can be an excellent hedge against inflation

- How they provide a good level of diversification and security

- How to choose the best gold IRA company from many options available on the market

Best Gold IRA Companies 2022

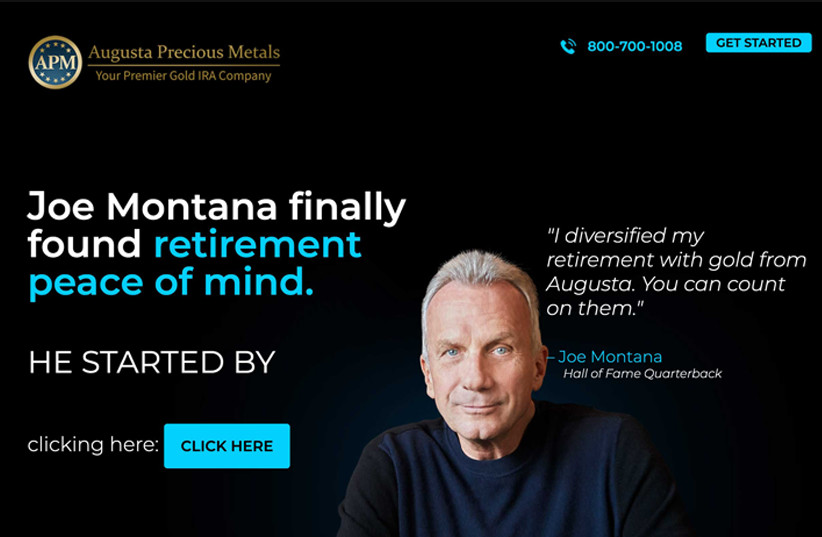

1. Augusta Precious Metals

Augusta Precious Metals ranks number one on our list due to lifetime customer support promise, user reviews exceeding expectations and a wide offering of different investment opportunities within the precious metals market.

- Augusta has thousands of 5-star customer reviews

- You can get even 10 years of fees waived when you sign up

- They offer informative webinars for free to customers new to investing

Click here to visit Augusta Precious Metals

2. Goldco

Goldco is a trusted gold IRA provider with 15 years of experience in precious metal investment. In recent years Goldco has been endorsed by Chuck Norris and Sean Hannity which helps them spread the gold investment educational materials.

- Goldco will guide you through the gold IRA setup process

- A lot of experience in precious metal investments

- Named the #1 IRA provider by INC. Magazine

3. Birch Gold Group

Birch Gold offers low setup and maintenance fees paired with a low minimum investment of $10,000. Couple that with great customer service and experienced management and you’ve got a great gold IRA provider!

- Minimum investment is only $10,000

- Founded in 2003

- Endorsed by Steve Forbes and Ben Shapiro

Click here to visit Birch Gold Group

What is a Gold IRA?

Like a regular IRA, a gold IRA is a retirement vehicle that specifically allows for investment in gold for retirement purposes. The investment can be in the form of bullion like gold coins or gold bars. Alternatively, there are other options available that include ETFs, mining companies, and commodity futures dealing in precious metals. Opening a gold IRA is fairly simple, and one can find several online brokers who provide these accounts.

Gold IRAs can be set up as a traditional IRA or a Roth IRA, depending on whether the account is funded with pre-tax or after-tax dollars. An investor opens a gold IRA account through a specialized custodian because regular brokers do not offer this product. These companies act as trustees for the investor and maintain the underlying assets of the gold IRA. Gold IRAs are a type of self-directed IRAs (SDIRA) wherein the investor makes the investment decision.

A gold IRA is the same as any IRA regarding the annual deposit limits. This means that there is a limit on the amount that can be deposited each year to all the IRA accounts of an investor. The tenure for a gold IRA is also the same as any other IRA. An additional tax is levied if withdrawals are made before the specified maturity period.

Advantages of gold IRA

The biggest advantage of a gold IRA is that it allows investors to consider gold as a viable retirement asset, whereas this option is not exclusively available in other IRAs. Gold and other precious metals are considered an effective hedge against inflation, something that has been increasing in recent years. Maintaining funds in a gold IRA helps preserve your real value of capital. The volatility of precious metals also tends to be lower during volatile market conditions, and gold IRAs can help cushion a loss experienced in equity and debt portfolios – the main benefit of diversification.

The minimum amount for investment depends on the broker, and some allow investments starting from a few hundred dollars. This is possible because bullion can be purchased in coins like American eagle, Britannia coins, and Queen's Beasts coins that weigh less than 100 grams.

Another advantage of a gold IRA to holding physical gold is that the investor does not have to worry about storing or securing the asset. The custodian maintains the asset in safe locations where the environment is also managed to prevent corrosion. Opening an account is also extremely simple these days, and all the purchases can be made online. Since most of the assets in an IRA are held in bullion form, the chances of fraud are also limited.

Disadvantages of gold IRA

The fees charged by IRAs holding simple equities and bonds are generally much less than gold IRAs. This is primarily due to the storage cost associated with holding physical gold. Many brokers also charge an annual charge for holding a gold IRA account. Since the tenure for these IRAs is long, the effective amount paid to cover these costs can be high.

Other drawbacks include the features of gold and other precious metals as an investment. There have been long periods when the price of gold has been flat. In such cases, the ability of gold to cover for inflation is limited, and the real returns are negative. Generally, the returns on equity markets are higher than gold, and therefore, there is a preference to invest in equity funds.

Another aspect of investing in gold is that the value is purely derived from its price. There is no interest or dividend income generated for gold, which is one reason why investors shy away from precious metals. Gold is more often looked upon by many as a value preserver instead of a value creator.

The investor does not actually possess the metal by investing in an IRA. Not only does he have to pay an additional tax for premature withdrawal, but the process can take up some time. This may not be optimal for some investors, especially during an emergency in which liquidity is of utmost importance. Holding physical gold with oneself may be appropriate in such a crucial time since it can be easily converted to money without the involvement of any third party. Gold IRAs also have a mark-up fee that has to be paid while purchasing or selling the holdings.

What to look for in a gold IRA company

Unless an investor can purchase or sell gold at reduced prices, it is recommended to use a broker to open an IRA account. Most brokers provide easy access to the account, and customer support is also available to support the investors. Some of the features that investors should look at while comparing multiple accounts have been listed below:

- Cost Involved: There are several costs involved in setting up a gold IRA account and purchasing precious metals. This is a key differentiator while choosing among different brokers. Some may also have hidden costs that the investor should be wary of. The costs are mark-up fees, custodian charges, set up and annual costs, and storage fees. There may also be costs related to transferring an IRA to a different institution should you wish to do so.

- The number of years in the business: With so many new players cropping up, it is necessary to select one that has proven itself historically. Many account providers tend to push users to open an account and neglect their fiduciary duty. A trustworthy company would be sensitive to the customer's needs rather than selling a product. An older business would also have customer feedback that a prospective investor can review.

- Products offered: Gold can be held in multiple forms but not all types of bullion are offered by each company. One can look at the bullion offered by each company before opening an account. Some of these companies also provide educational material to create awareness among investors. The customer support provided should also be checked to ensure quality communication. Reward programs for signing up are often offered, which should also be reviewed to make the most of your hard-earned investment dollars.

- Licenses, registrations: Regulatory licenses must be obtained to operate as a gold IRA company. Without these permits, the authenticity of the service provider may not be credible enough to park funds needed for retirement. For players operating without a license, the possibility of fraud is high. Even the quality of gold may be sub-standard.

- Management and other key employees: While the investment decision lies in one's own hands, emphasis should be placed on reviewing the company's key people. Expert management should be able to provide better facilities to customers compared to those who are new to this field.

The bottom line

gold IRA give better control to investors over their retirement money than other IRAs. These retirement vehicles picked up steam after the 2008 crisis and are a prudent investment choice. It is an excellent supplement to the other traditional IRAs, providing much needed diversification and security. Sometimes chasing returns should not be the ultimate goal, as capital preservation can be equally important.

Selecting a company can be challenging while opening a gold IRA account. Many of these companies do not reveal their actual fee structure. Before opening such accounts, a detailed review is necessary since your effective return may be reduced if the account holder does not understand the cost structure and fees. Based on my research Augusta Precious Metals will be the best choice for most investors based on their excellent user reviews and up to 10 years of fees waived on signup.

FAQ

What is a gold IRA?

A gold IRA can be considered a subset of an IRA that allows investors to invest in gold, silver, and other precious metals with the intention of holding these assets till retirement.

What are custodian fees?

The fees charged by custodians for storing the gold held are custodian fees. The custodian also generates tax reports for transactions conducted in the IRA account.

How to buy gold with 401(k)?

Indirectly, one can invest in gold ETFs through a 401(k) plan, but physical gold's direct purchase is not permitted. The other way is to opt-out of the 401(k) plan and deposit the funds in a self-directed IRA that permits investing in gold.

What's the minimum to start a gold IRA?

The minimum amount may vary depending on the company in which the gold IRA is opened. It is possible to open an account with an amount as low as $1000. If you want to invest in gold with a relatively low budget I recommend Birch Gold Group.