Mastercard's revenues depend directly on how much money people spend using cards with that very recognizable red-and-yellow logo. The more purchases, the more profits. However, we now live in a world better described by words such as crisis, recession and unemployment. In other words, there is no spare money. It's hard to imagine people splashing out in such circumstances. So why do analysts love Mastercard stock so much?

To start with, let's look at the chart below – we see that Mastercard stock is up almost 21% in the last six months. Not too shabby, given the current state of the world economy.

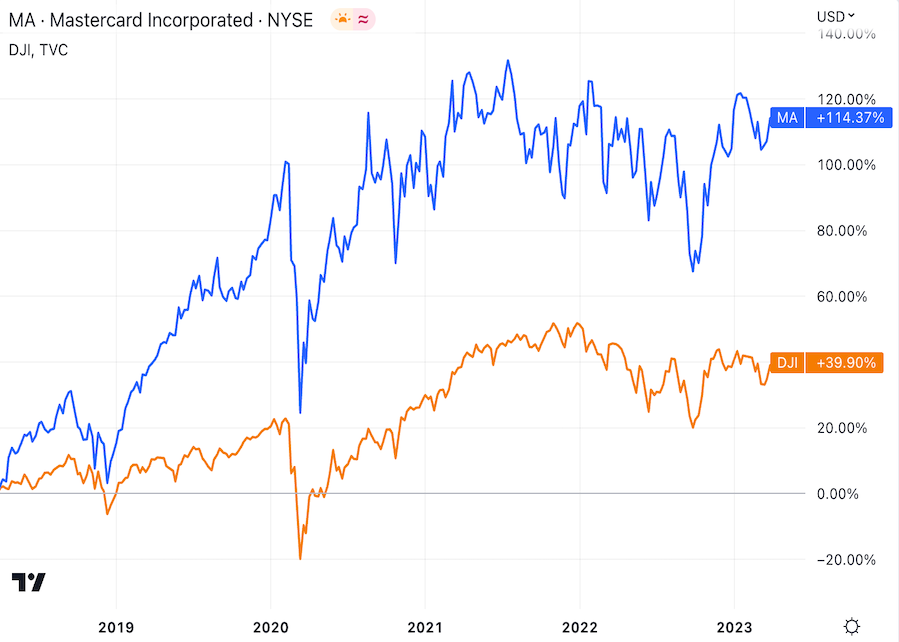

And growth is something that Mastercard should be pretty used to by now. In order to prove it, we can check the chart having Mastercard stock against the Dow Jones index over the last five years. If you haven't had time or opportunity to add this stock to your portfolio, there are chances that you won't like the chart below (sorry). However, if you want to know more about the factors affecting the markets, you can use specific trading tools. One of such tools is the economic calendar – it shows all the major economic events and helps predict the future movements of the markets.

The first reason for Mastercard’s ascent is the natural growth of debit and credit card use. It doesn’t matter if they pay by plastic, by phone, or even with their watch. Every day there are new online shops, deliveries, services – and we very rarely use cash to pay for any of it.

On the other hand, a significant portion of the population in some regions still prefers cash. Thus, Mastercard has a great opportunity for growth, gaining more new customers. Card purchases are just too darn convenient.

At this point, analysts notice that in the short-term period, Mastercard’s growth is unlikely to be too impressive. And it’s true – 2023 doesn’t look like a year of big spending. But from the long-term perspective, Mastercard’s prospects look rock solid.

An important characteristic of Mastercard is diversification. Or to be specific – a lack thereof. The company doesn’t engage in services such as credit. On the one hand, somebody can say that it reduces possible profit for the company in periods when the markets and the economy are on the rise. But, on the other hand, it makes the company’s revenue more stable, and allows Mastercard to survive crises more easily and emerge from them faster.

All these factors give analysts an opportunity to believe in Mastercard as in a wonderful long position for investors’ portfolio. The consensus forecast for Mastercard stocks is +18% in the next 12 months.

Remember – success in the stock market requires deep analysis. Not only should you read the opinions of experts, but you should also carry out your own analysis. High-quality research is (and always has been) the key to success.

This article was written in cooperation with TradingView