Israeli-Swiss fintech startup Okoora has launched an App Marketplace for ABCM, its integrated cloud platform for global payments, banking and risk management. The application market provides businesses with a secure and friendly environment for the purchase of additional services that improve the functionality of the platform when it comes to managing activity in different currencies.

The Okoora app market is part of a wider trend of democratization in the financial services sector. Open banking and regulatory changes have weakened the hold that large banks had in providing services that were perceived over the years as distinct banking services.

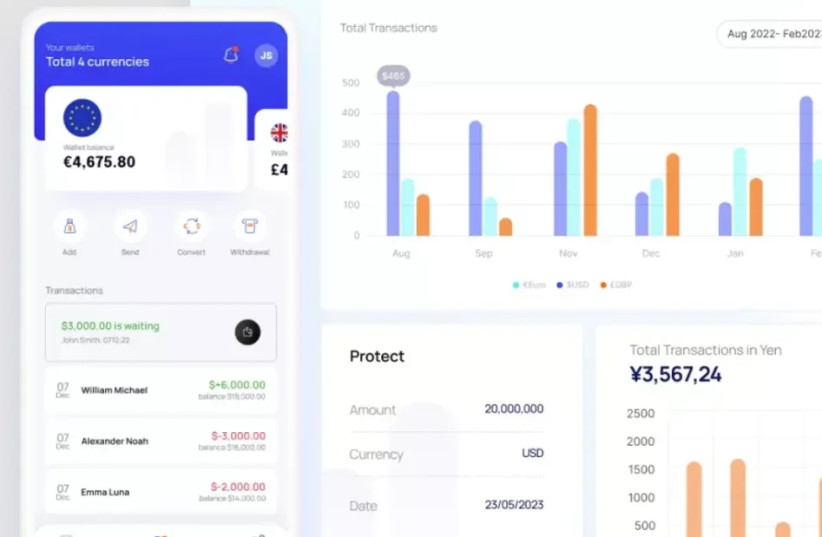

Okoora focuses on improving the work of small and medium-sized businesses in managing their currency activities and providing greater control through the ABCM platform, equipped with artificial intelligence capabilities. The app market is available to every customer, both to customers who are on a free plan and to paying customers of the platform.

At this stage, the application arena includes a series of applications, including the application of free outgoing payments (Free Outgoing Payments), through which companies can save costs by sending regular payments for free; FX Expert Package, which provides a team of experts who accompany the client in all the complexities related to foreign exchange management as well as the implementation of a foreign exchange hedging policy (FX Hedging Policy), which allows users to build a tailor-made policy for foreign exchange hedging that serves the goals their business strategies and needs.

Since the launch of the ABCM platform, Okoora has saved businesses in Israel over NIS 11 billion in international foreign exchange transactions while dealing with the worsening of financial risks in Israel in 2023 following the legal revolution and the war in Gaza. The platform doubled the number of customers in 2023, with approximately 15,000 customers registered so far for its use. In the last year, the company recorded a 465% increase in the payment transactions carried out by its customers and a 161% increase in the amount of protection transactions against currency exchange rate fluctuations.

Okoora has recently made significant moves towards penetrating the European market. At the end of last year, the company opened a branch in Limassol, Cyprus, and plans to launch offices in two more European countries this year. This move puts the start-up in a strong position towards obtaining licenses for full commercial activity in the 27 countries of the European Union.

"The app market is our next milestone in realizing our goal of democratizing financial services and empowering businesses so that they can shape their currency management experience," said Benny Avraham, CEO and founder of Okoora. "As we break through the limitations of traditional banking, we strive to improve the control and efficiency that small and medium businesses have in managing their currency activities."

Okura was founded in August 2021 by Benny Avraham, founder of Ofakim Group, the leading financial risk management company in Israel. The company became profitable in 2023 and is run as a bootstrap without investments from external investors. The company employs about 100 professionals in Israel, Switzerland, Germany, Cyprus and India and is recruiting dozens of additional employees for the company's branch in Israel in order to support its growth in Israel and abroad.